In 2025, the investment landscape for precious metals and critical minerals is evolving rapidly, with gold and uranium stocks commanding significant attention across agriculture, mining, energy, and infrastructure sectors. This dynamic shift is driven by the fundamental role these resources play in economic stability, technological advancement, and sustainability, all while navigating the complexities of global growth and geopolitical strategy.

Gold stocks, which surged over 15% in 2024, outpacing the S&P 500, are no longer just safe-haven assets. They are increasingly seen as strategic investments that hedge against inflation and volatility, diversify portfolios, and intersect with key sectors like agriculture, infrastructure, and defence. Gold mining companies contribute to these sectors by supporting rural economies, improving infrastructure, and supplying critical materials for advanced technologies. Firms with strong ESG commitments, advanced technologies, and proactive stakeholder engagement are particularly well-positioned for long-term value creation.

The best gold stocks to buy in 2025 include Newmont Corporation, Barrick Gold Corporation, AngloGold Ashanti, Agnico Eagle Mines Limited, and Gold Fields Limited. These companies stand out due to their robust reserves, ESG leadership, and technological integration. Sustainable mining practices, such as reducing water usage, limiting emissions, and restoring mined lands, are setting new sector standards. Additionally, blockchain-enabled traceability solutions are improving transparency and ensuring ethical sourcing, which is crucial for sustainable growth and social license to operate.

Technological advancements, such as satellite-based monitoring and AI advisory systems, are revolutionizing gold exploration and mining efficiency. These technologies enable real-time advice, weather forecasts, and multispectral satellite imagery, leading to more efficient and environmentally friendly practices. Fleet management tools further optimize transportation logistics, reducing costs and enhancing operational value.

Regional gold exploration is also gaining momentum, particularly in Africa, North America, and other resource-rich regions. African and Canadian mining firms are at the forefront of sustainable and technologically enhanced gold exploration, supported by investments in advanced mapping, AI analysis, and satellite-driven site discovery.

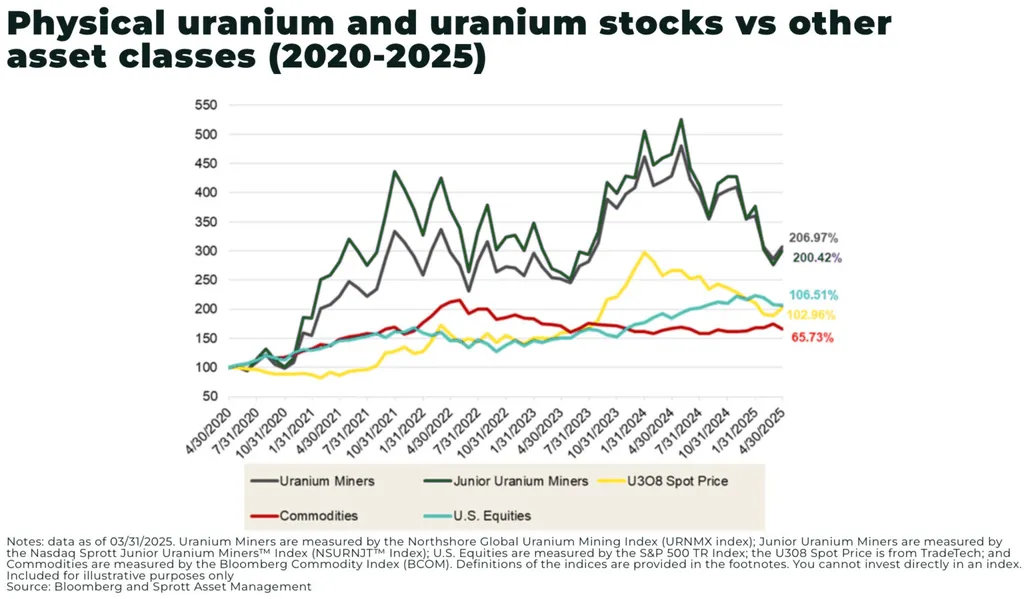

Uranium stocks are equally critical, given the projected 28% growth in global demand by 2030. Uranium is central to the clean energy transition and energy security, with applications in nuclear power, agriculture, and defence. The best uranium stocks to buy in 2025 are those with significant production capacity, scalable growth projects, and leading roles in nuclear supply chains. Companies like Cameco Corporation, Energy Fuels Inc., NexGen Energy Ltd., Denison Mines Corp., and Paladin Energy Ltd. are poised for growth due to their long-term contracts, advanced technologies, and strong ESG practices.

The implications for the sector are profound. As investors increasingly prioritize sustainability and technological innovation, companies that align with these values will likely outperform the market. The integration of advanced technologies and ESG frameworks is not just a trend but a necessity for long-term success. This shift could redefine the investment landscape, making it more dynamic and responsive to global challenges and opportunities. The race for gold and uranium is not just about resource extraction but about shaping a sustainable and secure future.