In a world where geopolitical tensions can send shockwaves through global markets, a new study sheds light on how these events impact carbon prices and what it means for clean energy investments. The research, published in the journal Energy Nexus, explores the intricate relationship between geopolitical risk (GPR) and China’s carbon markets, offering insights that could reshape investment strategies in the energy sector.

Lead author Anupam Dutta, from the School of Accounting and Finance at the University of Vaasa in Finland, combined advanced statistical models to uncover a nuanced picture. “We found that geopolitical shocks do indeed influence the Chinese carbon markets, but the effects are regime-dependent,” Dutta explains. By employing a Markov regime switching (MRS) model with a vector autoregressive (VAR) process, the study reveals that geopolitical risks have a significant negative impact during periods of high volatility, but this effect disappears in low volatility regimes.

The implications for investors and policymakers are substantial. The study suggests that higher geopolitical risk leads to higher hedging costs, but clean energy equities could serve as a suitable hedge for carbon market investments during times of uncertainty. “This is crucial for reaching net-zero goals,” Dutta emphasizes, highlighting the importance of understanding these dynamics in the transition to a sustainable energy future.

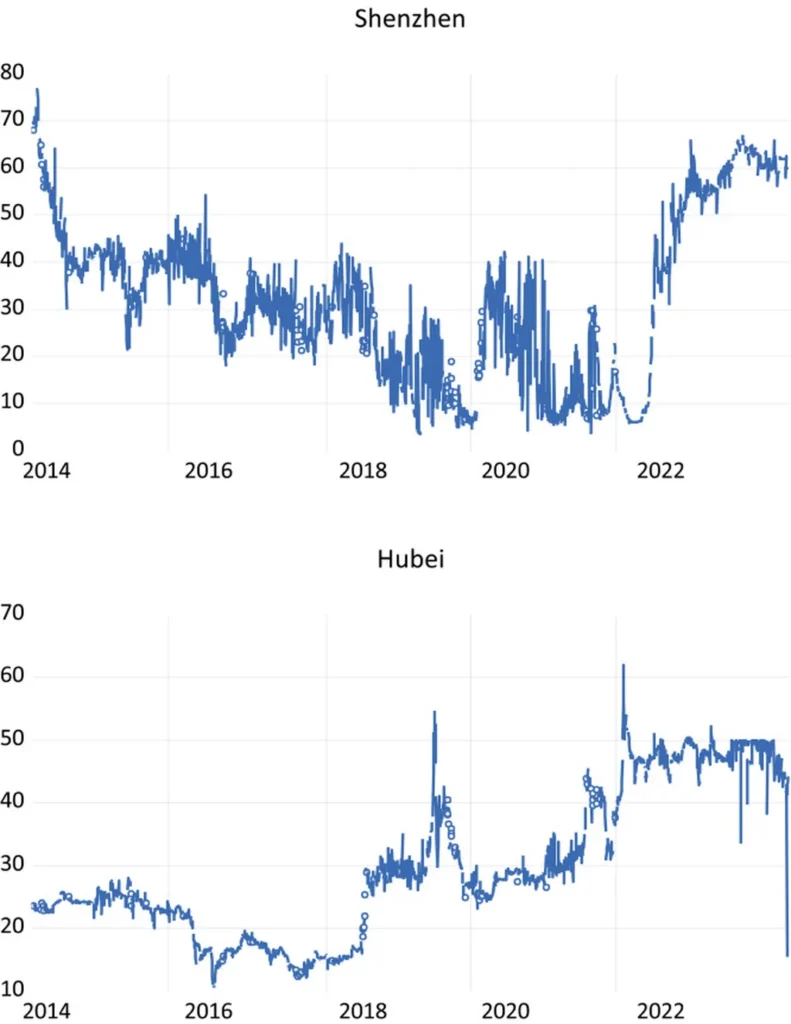

The research focuses on the Shenzhen and Hubei carbon markets, providing a microcosm of how geopolitical events can ripple through regional and potentially global carbon pricing mechanisms. The findings underscore the need for more sophisticated risk management strategies in the energy sector, particularly as countries navigate the complexities of carbon markets and geopolitical instability.

As the world moves towards sustainability, understanding these interactions becomes increasingly vital. The study not only contributes to the academic literature but also offers practical insights for investors, policymakers, and energy companies. By revealing the regime-dependent nature of geopolitical impacts on carbon markets, the research paves the way for more informed decision-making in an increasingly interconnected and volatile world.

For the energy sector, this research could shape future developments by encouraging a more nuanced approach to risk assessment and investment strategies. As Dutta notes, “The energy transition is not just about technology and policy; it’s also about understanding the broader economic and geopolitical context.” This study is a step towards that understanding, offering valuable insights for a sector navigating the complexities of a low-carbon future.