In the rapidly evolving energy landscape, virtual power plants (VPPs) are stepping into the spotlight as crucial players, aggregating distributed energy resources to navigate the complexities of modern electricity markets. However, these markets are fraught with uncertainties, particularly price volatility and the intermittent nature of renewable energy. A groundbreaking study published in the journal *Energies*, titled “A Two-Stage Cooperative Scheduling Model for Virtual Power Plants Accounting for Price Stochastic Perturbations,” addresses these challenges head-on. Led by Yan Lu of the Economic and Technical Research Institute of State Grid Jibei Electric Power Co. in Beijing, the research introduces a novel approach to VPP scheduling that could redefine how energy is traded and managed in the face of uncertainty.

The study marks the first application of Information Gap Decision Theory (IGDT) within a two-stage cooperative scheduling framework for VPPs. This innovative model incorporates both robust and opportunistic optimization methods, allowing VPPs to tailor their decision-making to different risk preferences. “Our model provides a flexible tool for VPPs to navigate the delicate balance between risk and return,” explains Lu. “By explicitly accounting for price uncertainty in the day-ahead stage and coordinating flexible resources in real-time, we can significantly enhance the integration of renewable energy and improve system flexibility.”

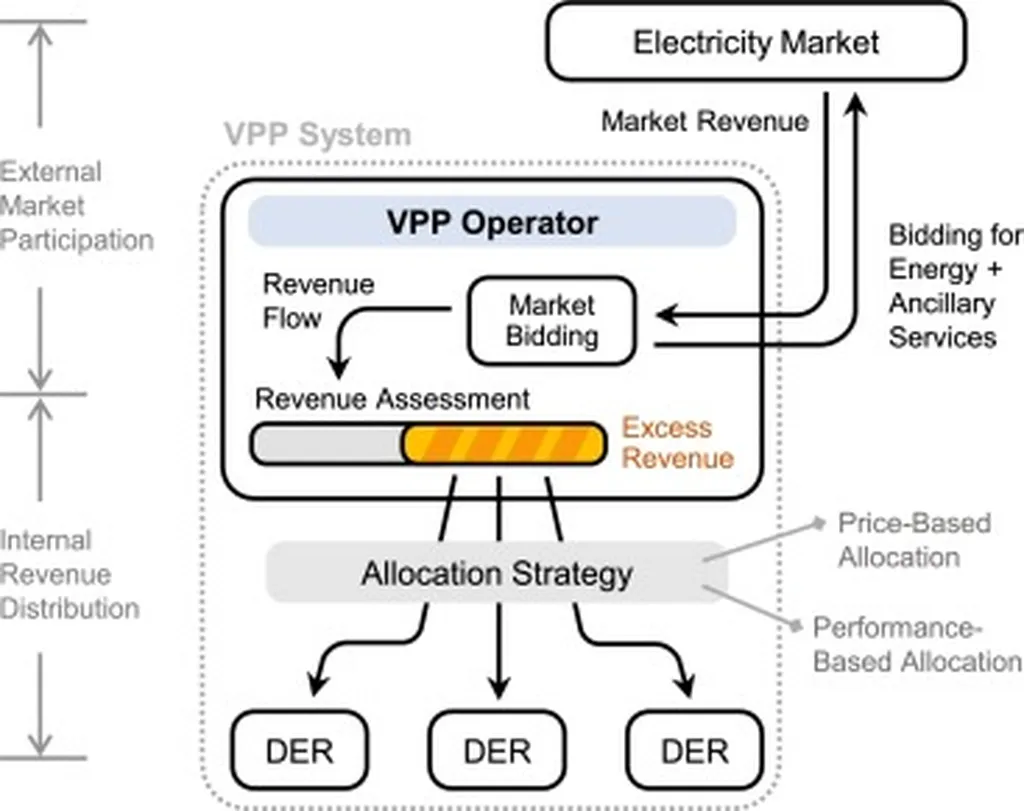

The two-stage approach is particularly noteworthy. In the day-ahead stage, the model employs a risk-responsive bidding mechanism to address price volatility. This proactive strategy helps VPPs mitigate potential losses due to unpredictable market fluctuations. In the real-time stage, the model coordinates the dispatch of micro gas turbines, energy storage systems, and flexible loads to minimize adjustment costs arising from deviations in wind and solar forecasts. This dual-stage strategy ensures that VPPs can adapt swiftly to changing conditions, optimizing their operations for both efficiency and profitability.

To validate their model, the researchers conducted a case study using spot market data from Shandong Province, China. The results were impressive, demonstrating that the proposed model not only achieves an effective balance between risk and return but also significantly improves renewable energy integration and system flexibility. “The case study underscores the practical applicability of our model,” notes Lu. “It offers a robust framework for VPPs to enhance their market participation and contribute to a more resilient and sustainable energy system.”

The implications of this research are far-reaching. By introducing a new modeling paradigm and a practical optimization tool for precision trading under uncertainty, the study offers both theoretical and methodological contributions to the coordinated operation of flexible resources and the design of electricity market mechanisms. As the energy sector continues to evolve, the ability to manage uncertainty and integrate renewable energy will be paramount. This research provides a crucial step forward in that direction, offering a blueprint for VPPs to navigate the complexities of modern electricity markets with confidence and precision.

In an era where renewable energy is increasingly integral to the energy mix, the work of Yan Lu and his team represents a significant advancement in the field. Their innovative approach to VPP scheduling not only addresses current challenges but also paves the way for future developments, ensuring that the energy sector can meet the demands of a rapidly changing world. As the energy transition accelerates, the insights and tools provided by this research will be invaluable in shaping a more flexible, resilient, and sustainable energy future.