In the dynamic world of energy markets, where prices fluctuate with the ebb and flow of supply and demand, predicting trends with accuracy is akin to navigating a labyrinth. However, a recent study published in the journal “IEEE Access” titled “Pattern-Based Feature Extraction for Improved Deep Learning in Financial Time Series Classification” offers a promising new approach to enhance the predictive power of deep learning models in financial time series classification. This research, led by Seyed Ali Hosseini from the Department of Energy at the Polytechnic University of Milan, could have significant implications for the energy sector, particularly in the realm of financial forecasting.

The study addresses a critical gap in existing financial forecasting models, which often struggle with the inherent volatility and complexity of financial markets. Traditional models rely heavily on open, high, low, close, and volume (OHLCV) data, which, while useful, fail to capture the intricate price patterns that can signal market trends. Hosseini and his team sought to bridge this gap by developing a novel feature extraction method based on pattern detection in financial data.

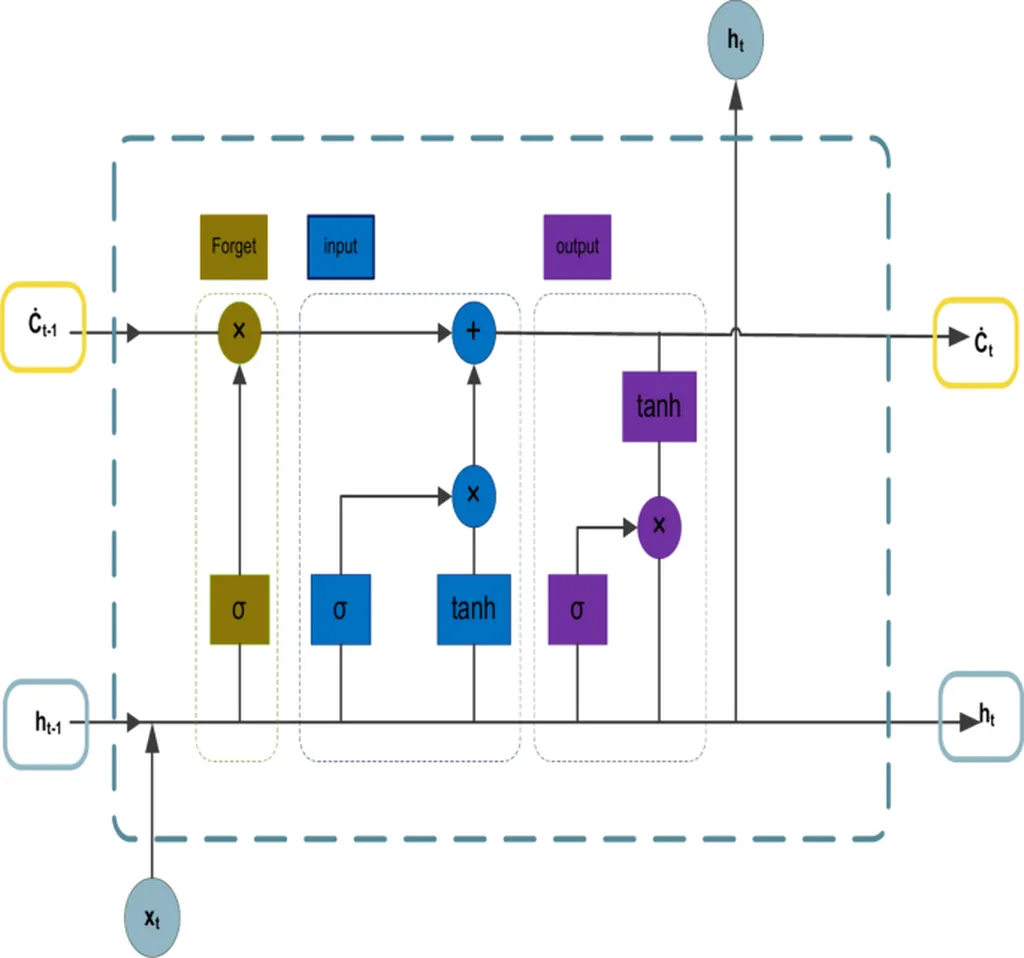

To achieve this, the researchers collected tick-by-tick data from the European Carbon Emission Allowance market and resampled it to a 15-minute timeframe. This allowed them to detect pivotal price patterns and extract relevant features. These features were then integrated with traditional OHLCV data and fed into long-short-term memory (LSTM) and gated recurrent unit (GRU) networks combined with dense neural networks. The results were impressive, with significant improvements in model performance and enhanced accuracy compared to models using only traditional data features.

“This approach not only improves the accuracy of financial forecasting but also provides a more comprehensive understanding of market dynamics,” said Hosseini. “By identifying and leveraging these patterns, we can make more informed decisions in the energy sector, ultimately leading to better risk management and investment strategies.”

The implications of this research are far-reaching. In the energy sector, accurate financial forecasting is crucial for effective risk management, investment strategies, and market stability. The ability to predict price trends with greater accuracy can help energy companies make informed decisions, optimize their portfolios, and mitigate risks. Moreover, this approach can be applied to other financial markets, enhancing the overall predictive capabilities of deep learning models.

As the energy sector continues to evolve, the integration of advanced technologies like deep learning and pattern recognition will play a pivotal role in shaping its future. This research by Hosseini and his team is a significant step forward in this direction, offering a novel approach to financial forecasting that could revolutionize the way we understand and navigate the complexities of energy markets.

In the ever-changing landscape of financial markets, the ability to predict trends with accuracy is invaluable. This research not only advances our understanding of market dynamics but also paves the way for more informed decision-making in the energy sector. As Hosseini aptly puts it, “The future of financial forecasting lies in our ability to detect and leverage these intricate patterns, and this research is a significant step in that direction.”