Jacopo Tosoni, Head of Policy at the European Association for Storage of Energy (EASE), paints a vivid picture of a sector in rapid flux. Energy storage, once a niche technology, is now a linchpin in Europe’s decarbonisation efforts. Its role in integrating renewables, enhancing grid resilience, and bolstering energy security cannot be overstated. Tosoni’s insights reveal a sector driven by falling costs, supportive policies, and the urgent need for grid flexibility.

The current state of energy storage in Europe is one of unprecedented growth. Tosoni describes it as the “most rapidly deployed clean tech solution” across the continent. This surge is not merely about capacity; it’s about the multifaceted value storage brings. It integrates renewables, prevents curtailment, reduces grid congestion, and enhances energy security. The recent energy price crises have underscored storage’s role in mitigating Europe’s dependence on fossil fuel imports, a point Tosoni emphasizes as increasingly critical.

The drivers behind this growth are multifaceted. Tosoni highlights the significant drop in battery system costs, which have surpassed earlier forecasts. Market evolution, with more frequent negative electricity prices, strengthens the business case for storage. Policymakers are also stepping up, implementing legislation that enables storage to compete fairly with other technologies. Support schemes for various storage technologies and market segments are on the rise, indicating a growing recognition of storage’s pivotal role.

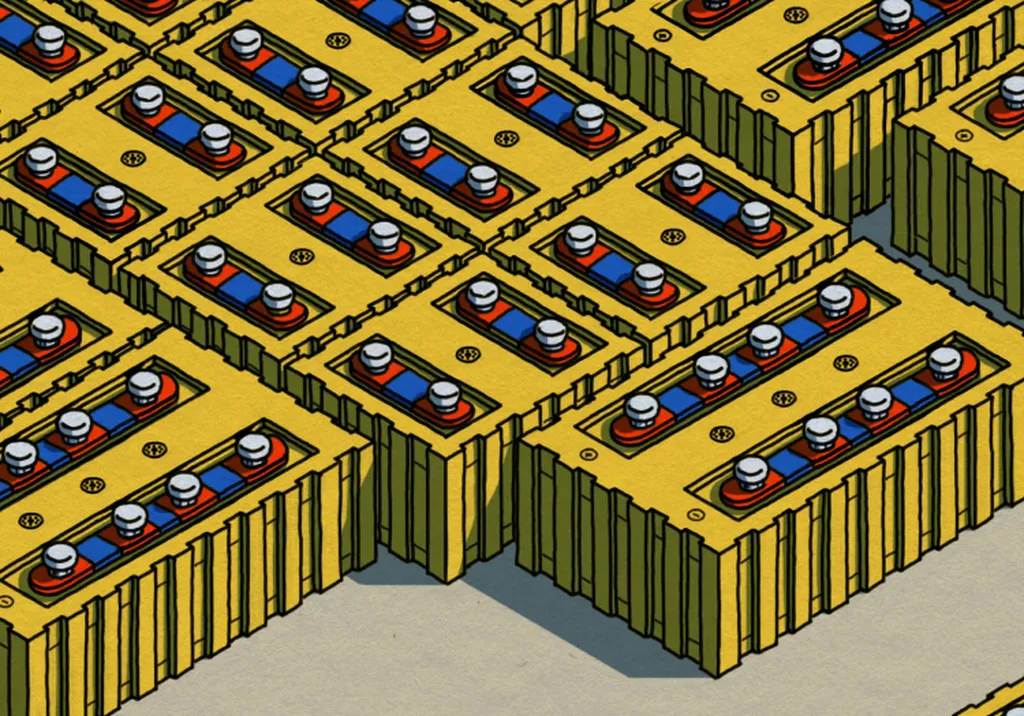

The balance between different storage technologies is shifting rapidly. Tosoni notes that pumped hydro, once dominant, is being overtaken by battery energy storage systems (BESS). This dramatic shift in less than a decade underscores the rapid evolution of the sector. Emerging technologies, such as those serving industrial decarbonisation or long-duration storage, are also gaining traction. While they may not become dominant, they will capture a more significant market share as the energy system evolves.

Co-location of storage with renewables is another trend gaining momentum. Tosoni points out the benefits for project developers, including better management of negative prices, reduced curtailment, and potential cost savings. This trend is particularly evident in solar projects, where co-location is becoming the norm. However, Tosoni also notes challenges, such as delays in grid connections and permitting processes. Bureaucracy remains a bottleneck, and regulatory frameworks are still catching up.

The momentum across different storage segments varies. Front-of-the-meter (FTM) storage is growing the fastest, with the commercial and industrial (C&I) segment holding untapped potential. Tosoni predicts that FTM will likely overtake behind-the-meter (BTM) storage within the next three years. Over the longer term, greater deployment in the C&I segment is expected, although this may take a few more years.

Tosoni’s assessment of European and national policies is nuanced. He acknowledges meaningful steps, such as the Clean Energy Package and the 2024 EU Electricity Market Design reform. However, he also notes delays in implementation and the need for more tailored regulatory frameworks. The reform’s requirement for member states to assess flexibility needs and set storage targets is a potential game-changer. Once fully implemented, it could have a significant market impact.

Looking ahead, Tosoni foresees continued growth and disruption. Many energy storage technologies are already mature technologically, but the sector’s evolution is far from over. The interplay of technological advances, policy support, and market dynamics will shape the future of energy storage in Europe. Tosoni’s insights underscore the sector’s critical role in Europe’s energy transition, highlighting both the opportunities and challenges that lie ahead.