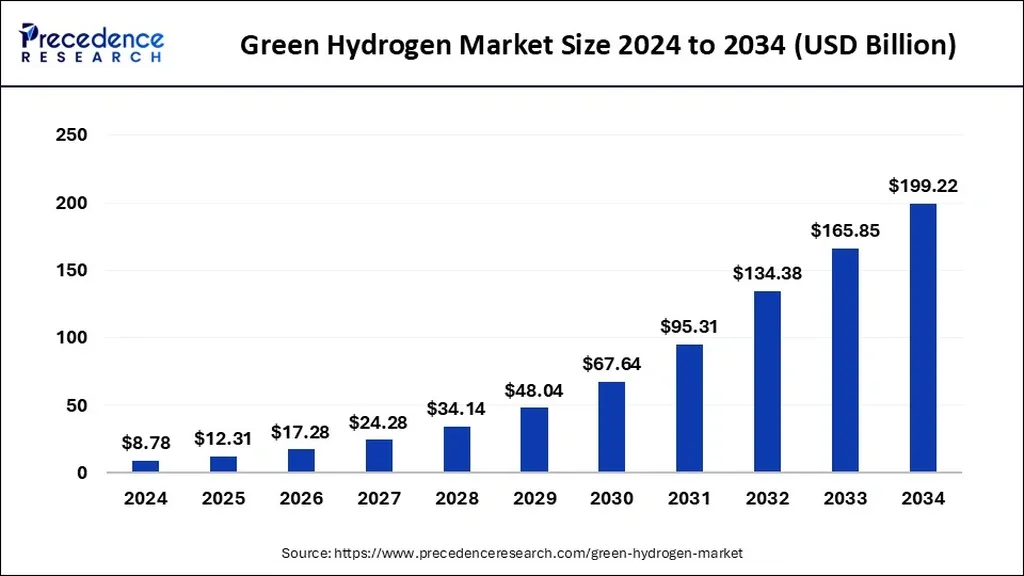

The global green hydrogen market is poised for a significant surge, with expectations to exceed USD 188.12 billion by 2034, growing at a robust CAGR of 35.95% from 2025 to 2034. This growth is fueled by a confluence of factors, including the rising demand for clean energy, supportive government policies, falling renewable energy costs, and ambitious decarbonization goals. As green hydrogen’s role expands across sectors like transport, power, and industry, its adoption and growth potential are becoming increasingly evident.

Green hydrogen, produced through the electrolysis of water using renewable energy sources such as wind and solar, is emerging as a key player in the clean energy transition. Environmental concerns over carbon emissions from fossil fuels, coupled with government initiatives promoting a hydrogen-based economy, are driving interest and investment in this sector. The United States, for instance, is at the forefront of this transition, with policy initiatives under the U.S. Energy Act emphasizing sustainable energy solutions. According to the Roadmap to a U.S. Hydrogen Economy report, hydrogen from low-carbon sources could meet approximately 14% of the country’s energy needs by 2050, particularly in hard-to-electrify sectors reliant on natural gas.

Europe, which generated the highest revenue share of 51.8% in 2024, is leading the charge in green hydrogen adoption. The region’s massive investment programs, such as the EU’s Green Deal, aim to produce millions of tons of renewable hydrogen by 2030. Germany and the United Kingdom are notable leaders, with Germany focusing on renewable energy integration and grid modernization, and the UK committed to expanding electrolytic hydrogen production and CCUS technologies.

Asia Pacific, capturing the second-highest revenue share of 23.2% in 2024, is also making significant strides. The India-Middle East-Europe Economic Corridor (IMEC), backed by major global players, signals a major step toward a global hydrogen economy. This initiative includes a hydrogen pipeline aimed at facilitating exports to the EU, highlighting the region’s strategic moves to establish green hydrogen supply chains.

In the transportation sector, which registered a 41.5% revenue share in 2024, green hydrogen is providing a clean-energy solution with the convenience and performance of fossil fuels, but without the emissions. Major European automotive manufacturers are aiming to transition truck fleets to hydrogen by 2040, and Airbus is developing hydrogen-powered aircraft with commercial operations targeted by 2035. The utilities sector is also seeing advancements, with green hydrogen playing a critical role in ensuring safe and efficient electrical grid operations.

However, the market faces challenges, particularly the high production costs of green hydrogen. Current electrolysis methods are significantly more expensive than conventional hydrogen production from fossil fuels. This cost gap is driven by high capital costs for electrolyzer units, expensive renewable energy inputs, lower efficiency of current electrolysis technologies, and underdeveloped infrastructure for storage and distribution.

Despite these challenges, rising government investments are creating significant growth opportunities. Regions are making strategic moves to establish green hydrogen supply chains, which are expected to lower production costs through scale and efficiency, enhance market accessibility, and accelerate global decarbonization goals.

Technologically, alkaline electrolyzers accounted for the largest market share in 2024, contributing 65.46% of total revenue. Known for their longer operational life and cost-effectiveness, they support continued growth in the segment. However, PEM electrolyzers are expected to experience higher growth over the forecast period due to their superior functional flexibility and higher proton conductivity.

In terms of distribution, pipeline distribution dominated the market with a 60.66% revenue share in 2024. Rapid development through partnerships and infrastructure projects, such as RWE and Equinor’s collaboration to establish pipelines from Norway to Germany, is driving this sector. Alternative transport modes, including trucks and ships using various carriers like liquid organic hydrogen carriers (LOHCs) and ammonia, are also being explored based on end-user applications and terrain.

The green hydrogen market’s growth trajectory is set to reshape the energy sector significantly. As governments and private sectors ramp up investments, the market is poised