American Electric Power Company, Inc. (AEP) is charting a course through a landscape of opportunities and challenges, with its strategic investments and operational risks set to shape its trajectory and potentially influence broader market trends. The company’s commitment to infrastructure enhancement and renewable energy expansion underscores a sector-wide pivot towards reliability and sustainability, but its exposure to retail electric providers (REPs) and regulatory pressures could introduce volatility.

AEP’s geographic diversification and expansive transmission network provide a buffer against regional market fluctuations, positioning it as a key player in the eastern U.S. grid. Its aggressive push into renewables, with $4.5 billion invested in new capacity and plans for $8 billion more by 2030, reflects a broader industry shift. This could accelerate the retirement of fossil fuel plants, particularly coal, as AEP’s fleet faces new EPA regulations. The company’s ability to navigate these transitions will be critical, as compliance costs and operational adjustments could strain its financial performance.

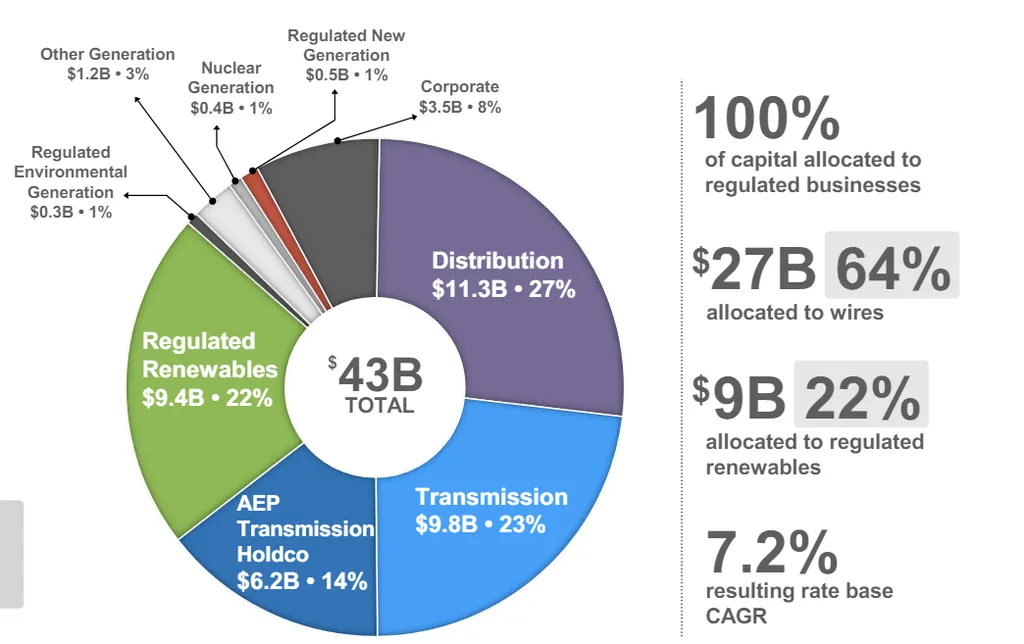

The company’s $72 billion capital investment plan aims to bolster its rate base and ensure reliable service, but the concentration of revenues among a few REPs in Texas introduces a significant risk. Payment delays or defaults from these providers could disrupt cash flows, highlighting a vulnerability that other utilities with similar structures may also face. Regulatory constraints limiting AEP’s ability to secure credit protections could force a reevaluation of risk management strategies across the sector.

AEP’s stock performance, while steady, lags slightly behind industry growth, suggesting investor caution. This could be a harbinger of broader market sentiment towards utilities with heavy exposure to REPs or those undergoing significant regulatory shifts. Meanwhile, competitors like Pinnacle West Capital, NiSource, and Ameren, with stronger earnings growth projections, may attract more investment, signaling a potential realignment in the utility sector.

As AEP and its peers adapt to these dynamics, the sector could see increased consolidation, with stronger players acquiring or partnering with those facing financial or regulatory headwinds. The push for renewables may also drive innovation in grid management and energy storage, as utilities seek to balance reliability with sustainability. AEP’s journey will be a bellwether for these trends, offering insights into the future of energy provision in an evolving market.