The North American electric grid is facing a significant challenge: demand growth is accelerating faster than resource additions, according to the 2025 Long-Term Reliability Assessment (LTRA) released by the North American Electric Reliability Corporation (NERC). The report projects that summer peak demand could surge by 224 GW—69% more than the 132 GW projected in the previous LTRA 2024. Winter demand could surge even more, by 245 GW, a 65% increase from last year’s 149 GW growth projection.

This dramatic spike in demand is primarily driven by data centers and artificial intelligence, but also includes large industrial facilities, electrified transportation, cryptomining, heat pump deployment, and demographic trends. However, NERC cautions that these projections are likely conservative, as they rely on load forecasts from utilities and system planners based on information from the interconnection process and agreements between utilities and owners of connecting loads.

The report reveals a massive build-out of data centers in many parts of North America, particularly in Texas, PJM, and the WECC assessment areas. “Balancing authorities (BAs) within WECC reported that planned data centers account for an average of 10% of demand, with some BAs reporting as high as 40% of the demand forecast,” the report notes.

John Moura, NERC director of Reliability Assessment and Performance Analysis, emphasized the uncertainty and magnitude of load growth. “We see real load growth,” he said. “We’re not counting every prospective data center, prospective demand, load center out there. We’re taking quite a bit of a haircut and looking at what’s reasonably expected to come in. That uncertainty and kind of what we know—the magnitude of load growth—is increasingly uncertain and its impact on planning—is going to have a significant risk.”

The LTRA evaluates where the system could face stress if conditions unfold as they’re currently planned. It shows that risk trajectory—not certainties—and that there is still time to act. The challenge, Moura predicted, “is not a lack of effort challenge. It’s really a pace and scale of the system transformation occurring at the same time as demand growth accelerates.”

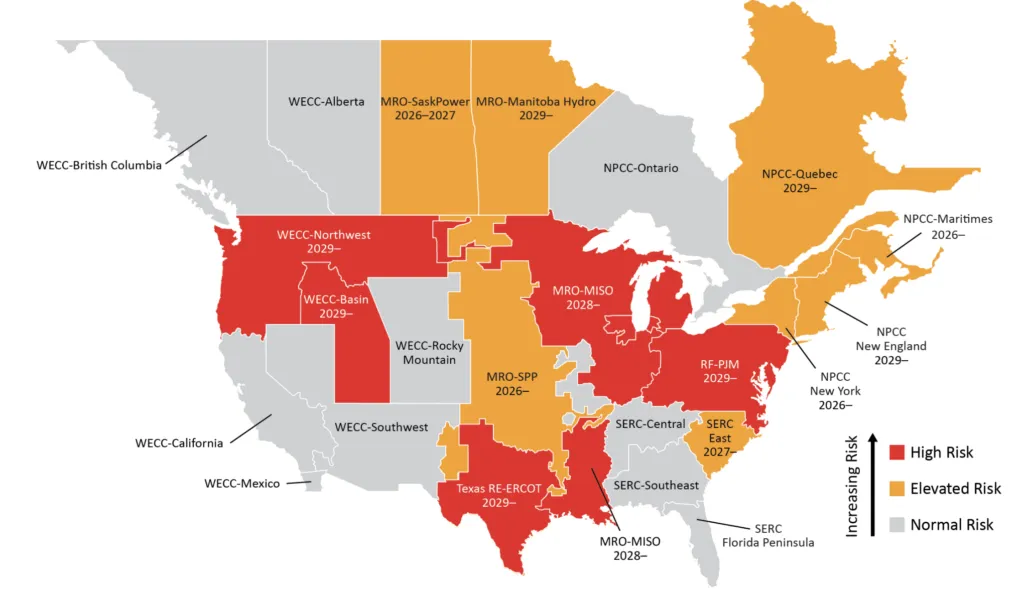

Five regions could face ‘high risk’ by 2030, according to Mark Olson, NERC’s manager of Reliability Assessments. These regions include the Midcontinent Independent System Operator (MISO), PJM Interconnection (PJM), the Electric Reliability Council of Texas (ERCOT), and the Western Electricity Coordinating Council’s (WECC’s) Basin and Northwest subregions.

Olson explained that “resource adequacy concerns are mounting,” meaning that despite surging demand expectations, projected supply growth is not keeping pace. Thirteen of 23 assessment areas will face resource adequacy challenges over the next five years.

The regions facing the highest risk are contending with steep load growth that consistently outpaces planned resource additions, particularly as thermal retirements mount and solar-heavy additions introduce variability. In ERCOT and PJM, demand from data centers could erode resource margins below targets later in the decade despite efforts to expedite new capacity. And in parts of the Western Interconnection, growing reliance on variable renewables could contribute to year-round adequacy concerns.

Elevated-risk areas—including portions of MRO, NPCC, and SERC—could grapple with other specific vulnerabilities such as low-hydro conditions, fuel constraints, peaker retirements, and seasonal maintenance gaps that heighten the risk of energy shortfalls, particularly under extreme weather.

This news shapes the development in the sector by highlighting the urgent need for accelerated investment in grid infrastructure and resources to meet the growing demand. It also underscores the importance of diversifying energy sources and improving grid flexibility to ensure reliability in the face of increasing uncertainty. The report serves as a call to action for stakeholders to address these challenges proactively and collaboratively.