Brian Mulberry, senior client portfolio manager at Zacks Investment Management, offered a nuanced perspective on the shifting investment landscape during an interview with BNN Bloomberg. His insights reveal a sector rotation that could reshape the energy and materials markets, with broader implications for the entire economy.

Mulberry highlighted the early-year strength in energy and materials, sectors that have climbed more than nine percent year to date. This surge is driven by demand for copper, power generation, and AI infrastructure buildouts, as investors reassess technology valuations ahead of earnings season. The capital expenditure from large technology firms is flowing into mining, utilities, and industrial companies supplying data centres and grid expansion. This trend underscores a significant shift in investment priorities, with capital moving away from traditional tech stocks towards sectors that support AI infrastructure and power generation.

The discussion also touched on uranium and defence stocks, which are benefiting from expectations of increased nuclear power generation and durable government-backed spending. Mulberry emphasized the importance of raw materials in the global push for nuclear energy, noting that the mining stocks directly involved in extracting these materials are poised for growth. This aligns with the broader trend of investing in sectors that support the transition to cleaner energy sources.

Investor scrutiny is rising around large AI-related capital spending, with questions about when profitability will materialize for major technology firms. Mulberry suggested that the focus should be on the companies benefiting from this spending, rather than the tech giants themselves. This approach involves investing in mining and materials companies that supply the necessary raw materials for AI infrastructure, as well as utilities companies that produce the electricity to power these data centres.

The interview also delved into the financial sector, with Mulberry noting that the upside from IPOs and mergers depends on lower long-term bond yields. He indicated that meaningful deal activity is likely only if the U.S. 10-year Treasury yield falls below four percent. This highlights the interconnectedness of the financial markets and the need for favourable economic conditions to spur investment activity.

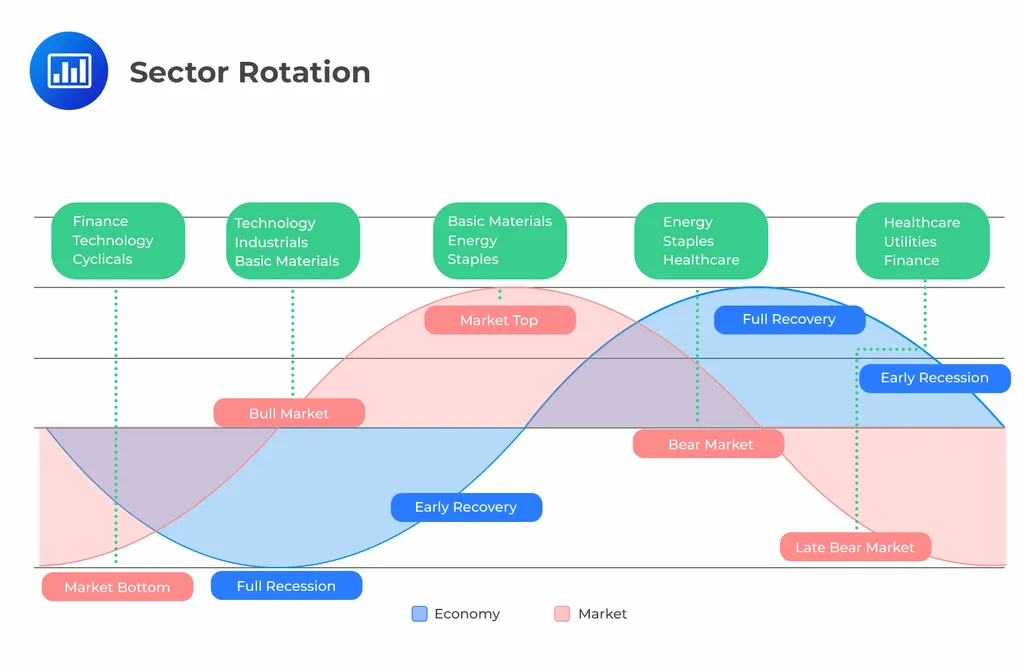

Mulberry’s insights suggest a broader rotation towards sectors tied to AI infrastructure, power generation, and raw materials. This shift could have profound implications for the energy and materials sectors, as well as the broader economy. Investors are increasingly focused on the profitability timelines of large AI investments, which is driving capital towards sectors that support these technologies. This trend could lead to a more diversified investment landscape, with a greater emphasis on the companies that supply the necessary materials and infrastructure for the digital age.

The implications of this sector rotation are significant. As capital flows into energy, materials, defence, and utilities, these sectors could experience sustained growth and increased investment. This could lead to innovation and development in these areas, as companies seek to meet the growing demand for raw materials and power generation. Additionally, the focus on profitability timelines for large AI investments could lead to a more cautious approach to investment in the tech sector, with a greater emphasis on the companies that support AI infrastructure.

In conclusion, Mulberry’s insights provide a valuable perspective on the shifting investment landscape. His analysis highlights the importance of raw materials and power generation in the digital age, as well as the need for favourable economic conditions to spur investment activity. As investors reassess technology valuations and focus on profitability timelines, the energy and materials sectors could experience sustained growth and increased investment. This trend could have profound implications for the broader economy, leading to innovation and development in key sectors and a more diversified investment landscape.