Brazil’s strategic maneuvers to secure its gas supply reveal a complex dance of domestic production, regional integration, and global market dynamics that will reshape the nation’s energy security landscape for decades. The country’s race to bolster gas supply isn’t just about meeting immediate demand; it’s a calculated response to declining Bolivian imports, the rise of pre-salt production, and shifting regional demand patterns. This intricate interplay demands sophisticated infrastructure solutions and coordinated policy responses, with global economic shifts adding another layer of complexity.

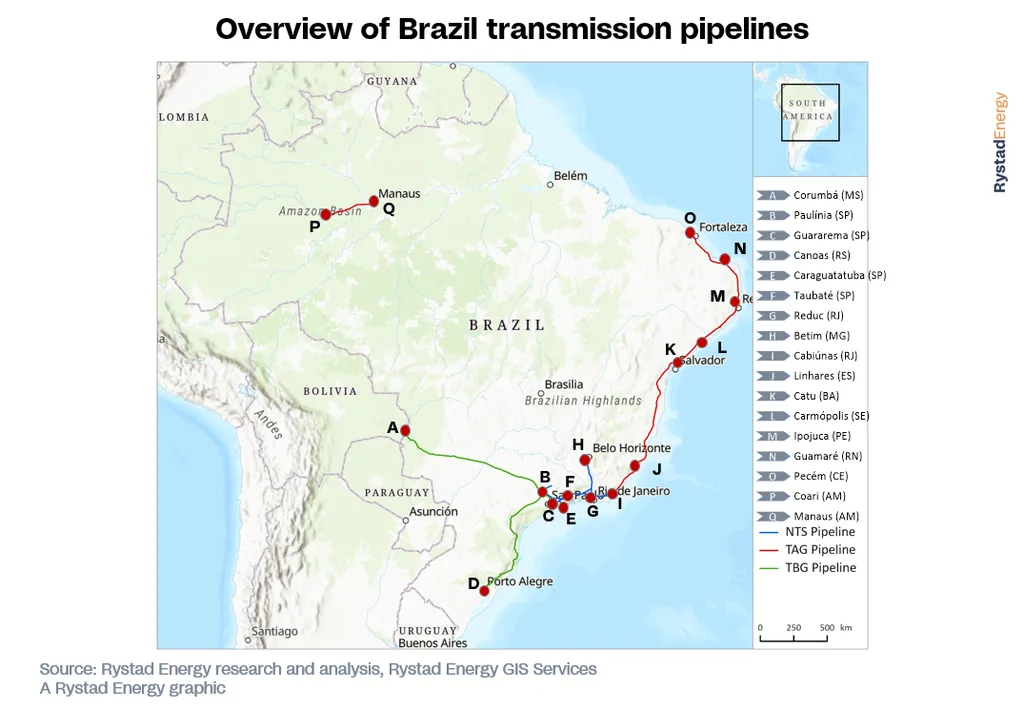

Strategic compression and pipeline enhancement programs are at the heart of Brazil’s efforts to fortify its gas supply. The TAG network’s ECOMP Itajuipe compressor project, for instance, aims to add 3 million cubic meters per day (MMcmd) of transfer capacity by 2028, a move that underscores the importance of incremental capacity optimization. Similarly, the GASOG pipeline project demonstrates how Brazil is integrating private LNG infrastructure with national transmission networks to enhance supply diversification, a critical consideration given emerging LNG supply opportunities globally.

In the Northeast, acute supply-demand imbalances are being addressed through a multi-phase regional integration strategy. The Veredas project, for example, targets expanding capacity into Ceara through phased duplication of the Nordestao pipeline, directly supporting growing demand while providing integration pathways for future SEAP gas production from 2030 onwards. This phased approach allows Brazil to manage supply transition risks effectively, ensuring a smoother shift from declining Bolivian imports to new domestic sources.

Brazil’s domestic gas production expansion centers on the Sergipe-Alagoas Basin development (SEAP), with the Raia project providing a crucial bridge supply from Campos Basin pre-salt reserves by 2028. The Raia project’s 200-kilometer offshore export pipeline represents significant subsea infrastructure investment, positioning it as a critical supply source during the transition period before major SEAP operations commence.

Cross-border integration with Argentina presents both opportunities and risks. The proposed Uruguaiana-Triunfo cross-border pipeline, requiring $1.7 billion investment for 15 MMcmd capacity, highlights Brazil’s ambition to diversify its supply sources. However, achieving meaningful supply diversification through cross-border pipeline connections will necessitate substantial infrastructure and commercial development, as well as coordinated investment decisions and regulatory approvals.

In the Southeast, the NTS network is addressing declining Bolivian import reliability while managing growing pre-salt production integration requirements through the Corredor Pré-Sal Sul development. This ambitious project could enable significant interstate flow capacity and enhance market integration, but its success hinges on securing final investment decision approval and managing supply security risks during the transition period.

Brazil’s first strategic gas storage facility represents a fundamental shift toward demand variability management and supply security enhancement. The facility’s location in the Alagoas Basin provides strategic positioning for both Northeast market supply and Southeast production integration, addressing seasonal demand variations and supply disruption mitigation.

Renewable gas integration plays a crucial role in Brazil’s supply security strategy. TBG’s biomethane hub development exemplifies how Brazil is leveraging agricultural waste utilisation to diversify its supply sources, reduce carbon intensity, and support rural economic development. The integration of renewable gas sources provides operational flexibility and complements conventional supply strategies, optimizing capital allocation across multiple supply security initiatives.

Critical infrastructure bottlenecks, such as the Cacimbas-Catu pipeline restriction, constrain market integration efficiency and limit supply flexibility. Addressing these bottlenecks is essential for enhancing natural gas price trends and ensuring market stability.

The implications for the sector are profound. Brazil’s strategic investments in gas infrastructure and supply diversification will not only enhance its energy security but also influence regional energy markets and global LNG dynamics. The country’s approach to integrating renewable gas sources and managing supply transition risks offers valuable lessons for other nations grappling with similar challenges. As Brazil navigates this complex energy landscape, its decisions will shape the future of the global gas market and set a precedent for sustainable energy security strategies.