PJM Interconnection has revised its near-term peak-demand projections downward in its updated 20-year load forecast, citing stricter vetting of large-load adjustment requests and revised assumptions about electric vehicles (EVs) and economic activity. However, the grid operator maintains that significant long-term growth will be driven by data centers and broader electrification.

In its 2026 Long-Term Load Forecast, released on January 14, PJM expects lower peak demand in the near-term—at least through 2032—compared to last year’s report. The projections reflect updates to EV and economic forecasts, as well as more stringent vetting of requested adjustments for data centers and large loads. For instance, the updated load forecast for summer 2026 predicts a drop in peak electricity use attributed to large loads (-0.7%), economic activity (-0.5%), and EVs (-0.1%) compared to the PJM 2025 Long-Term Load Forecast Report.

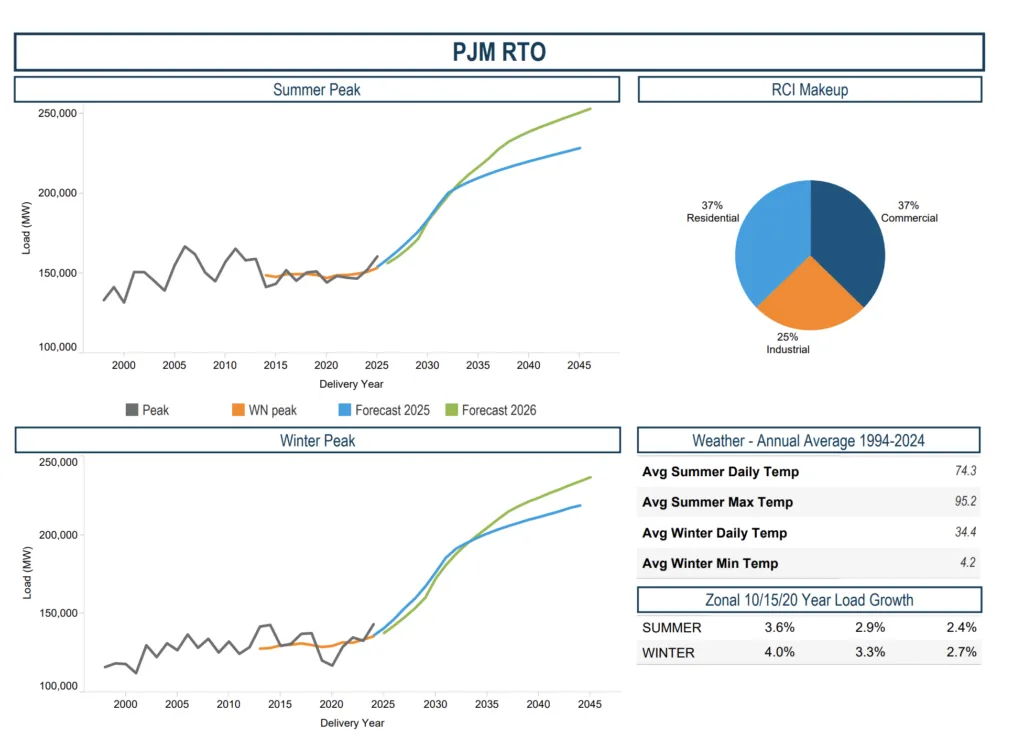

Despite the near-term adjustments, PJM’s long-term growth outlook has surged. The grid operator projects summer peak demand growth at an average annual rate of 3.6% over the next decade, with winter peak demand surging even higher, at an annual rate of 4.0%. This is up from 3.1% and 3.8%, respectively, in the 2025 forecast. PJM also expects net energy demand to grow 5.3% per year over 10 years, compared with 4.8% in last year’s outlook.

The latest update suggests that summer peak demand could increase by roughly 85,000 MW over the next 15 years, reaching more than 241,000 MW—which is well above the system’s record summer peak of 166,929 MW set in 2006. While winter peak demand is expected to remain slightly lower than summer, the 2026 report shows winter peak is poised to close the gap, with peak winter load estimated at nearly 224,000 MW by 2041.

PJM’s updated load forecast incorporates a new framework that distinguishes “firm” from “non-firm” large load additions. Near-term forecast years—which PJM defines as loads coming online within three years—now require Electric Service Obligations or Construction Commitments before PJM will include them in capacity market and transmission planning assumptions. Longer-term projects lacking such documentation are treated as “non-firm” and probabilistically de-rated based on the likelihood of completion.

This approach, formalized through PJM’s Load Adjustment Request Implementation document published in July 2025, filters out speculative or duplicative requests—primarily data centers—that lack sufficient legal or financial commitments. PJM also updated its EV adoption assumptions and incorporated revised economic inputs from Moody’s Analytics’ September 2025 release.

The load forecast changes affect 15 of PJM’s transmission zones, with 14 zones where data center development was a contributing factor. Twelve zones received standard data center growth adjustments, while Dominion Virginia Power and Public Service Electric & Gas received adjustments for data center growth plus additional factors like voltage optimization programs and port electrification. East Kentucky Power Cooperative received an adjustment for its peak-shaving program.

This revised forecast could shape the development of the energy sector in several ways. The near-term reduction in peak demand projections may alleviate immediate pressure on grid operators to procure additional capacity, potentially impacting short-term investment decisions. However, the long-term growth outlook underscores the need for significant infrastructure investments to accommodate rising demand from data centers and broader electrification.

The stricter vetting process for large-load adjustments may also influence how developers approach new projects, encouraging more detailed planning and financial commitments upfront. Additionally, the updated EV adoption assumptions could impact planning for charging infrastructure and grid modernization efforts.

As the energy sector navigates these shifts, the PJM forecast serves as a critical benchmark for stakeholders, highlighting the delicate balance between managing near-term demands and preparing for long-term growth.