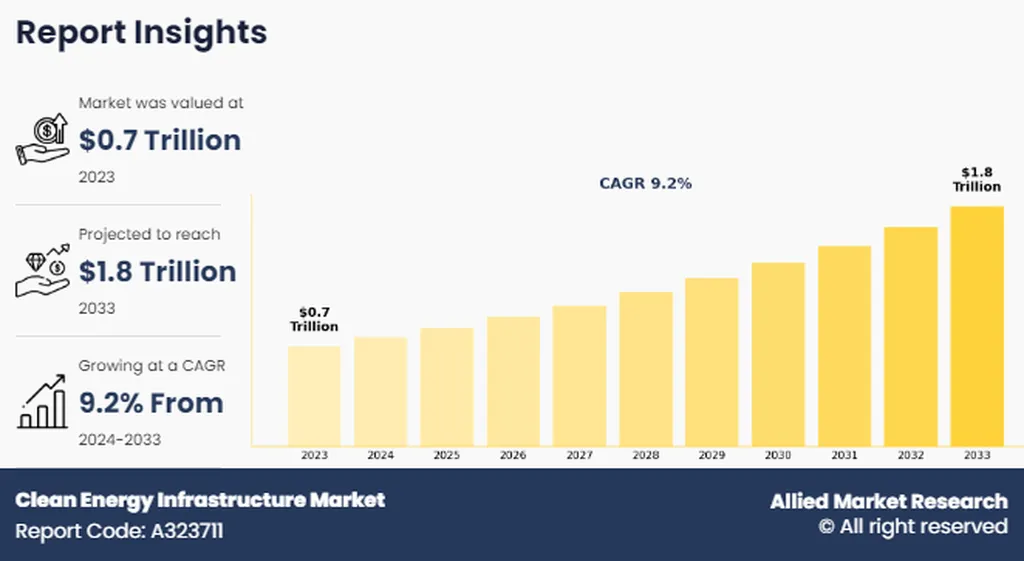

The clean energy infrastructure industry is on a trajectory to nearly triple in size over the next decade, a shift that could reshape global energy markets and accelerate the transition away from fossil fuels. The projected growth, from $0.7 trillion in 2023 to $1.8 trillion by 2033, is driven by a confluence of factors, including renewable energy adoption, electric vehicle (EV) infrastructure expansion, and strong government support. This expansion is not just about market size; it’s about the fundamental restructuring of how energy is generated, stored, and distributed.

The rapid global push to decarbonize energy systems is a significant driver. Governments and private investors are prioritizing infrastructure upgrades to meet international climate targets, such as the Paris Agreement. This focus on sustainability is creating a ripple effect across various sectors, from utilities to transportation. The electrification of transportation, for instance, is a major growth opportunity. The shift toward electric vehicles is driving demand for renewable-powered charging networks, which in turn is spurring investments in solar, wind, and energy storage technologies.

However, the path is not without challenges. High initial investment costs remain a significant barrier, particularly in developing regions. While clean energy infrastructure offers long-term economic and environmental benefits, the upfront capital requirements can be prohibitive. This financial hurdle could slow adoption rates, despite the long-term advantages.

The competitive landscape is also evolving. Major players are focusing on capacity expansion, technological innovation, and strategic partnerships. Companies like NextEra Energy, Enel SpA, and Iberdrola are investing heavily in large-scale renewable energy projects and grid modernization. This competition is likely to drive down costs and improve efficiency, making clean energy more accessible.

Regionally, the Asia-Pacific market is expected to grow at the fastest rate, driven by rapid urbanization and industrial expansion. North America and Europe continue to lead in terms of policy frameworks and technological advancements, while the Middle East and Latin America are emerging as promising markets. This regional diversity suggests that the clean energy infrastructure market is becoming increasingly global, with different regions playing to their strengths.

The implications for the energy sector are profound. The shift towards clean energy infrastructure could lead to a more decentralized energy system, with a greater emphasis on renewable sources and energy storage. This could reduce dependence on fossil fuels and improve energy security. Additionally, the integration of smart grids and energy-efficient buildings could enhance grid resilience and reduce energy waste.

In conclusion, the growth of the clean energy infrastructure market is a clear indication of the global shift towards sustainability. However, the pace and extent of this transition will depend on overcoming financial barriers, fostering innovation, and maintaining strong government support. The next decade will be crucial in determining whether this market can deliver on its promise of a cleaner, more sustainable energy future.