Constellation has finalized its acquisition of Calpine Corp. from Energy Capital Partners (ECP), forming the largest electricity producer in the U.S. The $26.6 billion cash-and-stock deal, including debt, unites Constellation’s nuclear power fleet with Calpine’s natural gas-fired and geothermal generation. The transaction, initially announced as a $16.4-billion deal last year, was completed on January 7.

The merged company aims to power data centers, advanced manufacturing facilities, and critical infrastructure. Joe Dominguez, president and CEO of Constellation, stated, “This isn’t just about two great companies coming together—it’s about strengthening America’s future.” He emphasized the strategic importance of the merger in meeting the nation’s surging energy demand and supporting AI leadership.

Andrew Novotny, president and CEO of Calpine, echoed this sentiment, highlighting the combined company’s ability to serve customers and communities while supporting national priorities for energy security, economic competitiveness, and technological leadership. “We have the assets that power America today and meet the needs of tomorrow,” Novotny said.

Tyler Reeder, president and managing partner of ECP, expressed pride in achieving the goals set out in the partnership with Calpine’s management team. “As a decades-long investor in power generation, ECP aims to unlock value, drive long-term growth opportunities and strengthen asset reliability,” Reeder noted. He believes the combination validates ECP’s vision, setting Calpine up for future success.

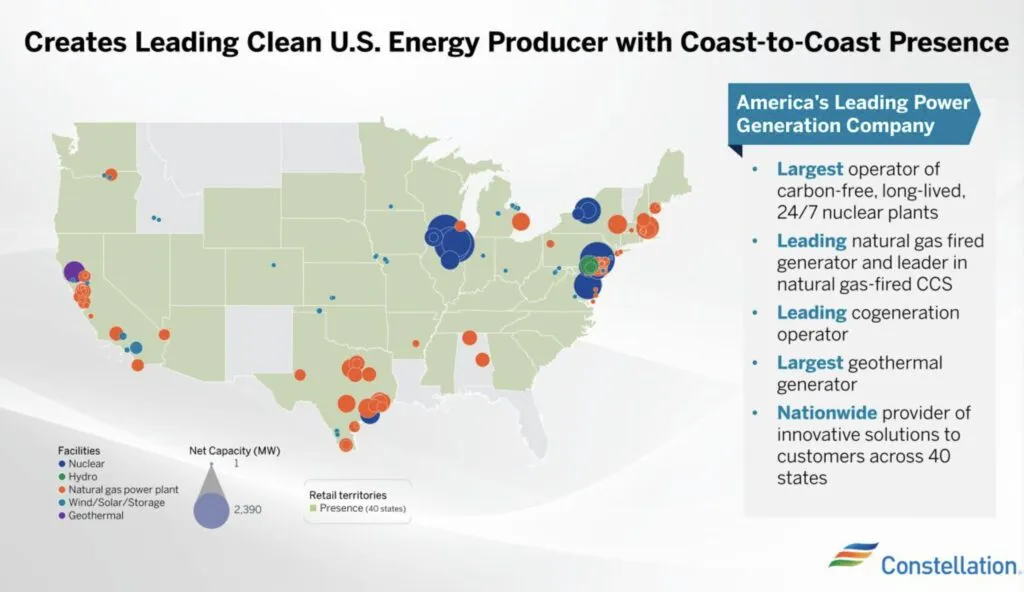

The combined company will serve 2.5 million retail and business customers nationwide, with a strengthened footprint in high-demand regions like Texas and California. Constellation and Calpine together boast 55 GW of generation capacity. The company will maintain its headquarters in Baltimore, Maryland, along with a significant presence in Houston, Texas.

This merger could significantly reshape the U.S. energy landscape. By combining nuclear, natural gas, and geothermal assets, the new entity is well-positioned to meet the growing demand for reliable, clean energy. The focus on powering data centers and advanced manufacturing facilities aligns with the nation’s technological and economic priorities. Additionally, the strengthened presence in key regions like Texas and California could enhance energy security and grid stability.

The merger also underscores the increasing importance of energy security and technological leadership in the global market. As the U.S. competes with other nations for AI and technological dominance, a robust and reliable energy infrastructure will be crucial. The combined company’s commitment to safety, sustainability, and operational excellence could set a new standard for the industry.

Moreover, the deal highlights the role of private equity in driving growth and innovation in the energy sector. ECP’s involvement in the transaction demonstrates the potential for private investors to unlock value and drive long-term growth opportunities. This could encourage further investment and collaboration in the energy sector, fostering a more dynamic and competitive market.

In conclusion, the merger of Constellation and Calpine is a significant development in the U.S. energy sector. It combines substantial generating capacity, strengthens regional footprints, and aligns with national priorities for energy security and technological leadership. The deal could set a precedent for future mergers and acquisitions in the industry, driving growth and innovation in the years to come.