The OpenAI and SoftBank joint investment in SB Energy to build a 1.2-gigawatt data centre in Texas is more than just another headline in the AI infrastructure race. It underscores a critical, often overlooked challenge: electricity is now AI’s most pressing bottleneck. Without addressing this, the sector’s growth could stall, regardless of advancements in capital, chips, or code.

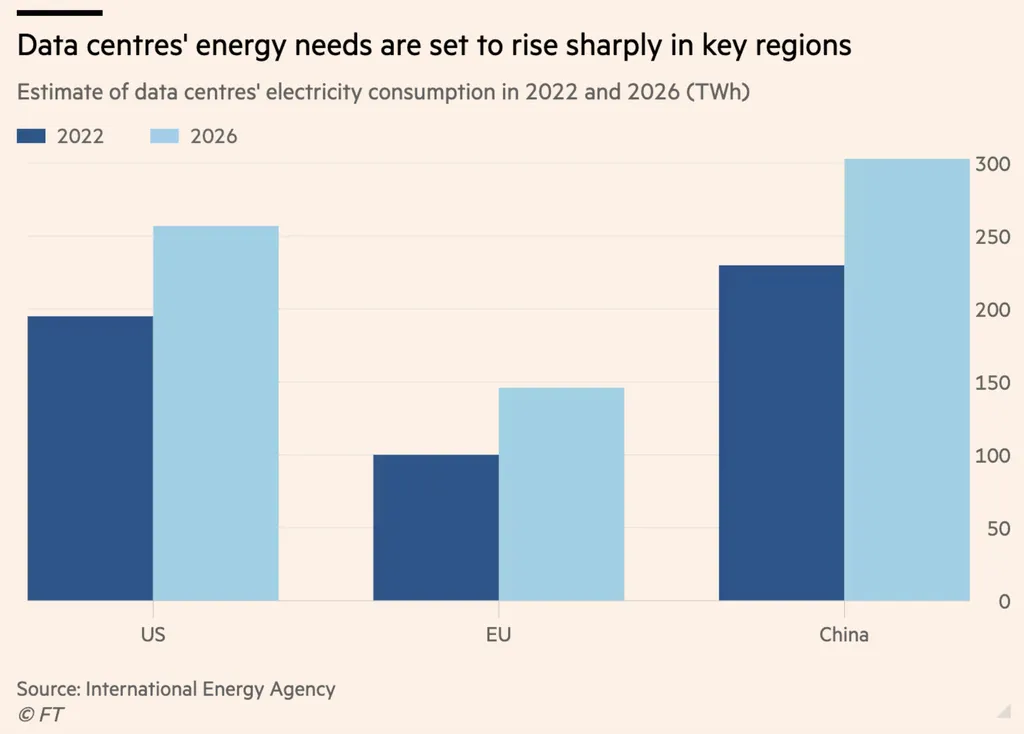

The economics are stark. A single gigawatt of continuous power supplies roughly 750,000 American homes. Yet, data centres are clustering these demands in concentrated zones, straining grids designed for steady, predictable loads. Between 2017 and 2023, data centre electricity demand more than doubled, driven by AI-accelerated servers. The Lawrence Berkeley National Laboratory estimates that data centre consumption will reach between 325 and 580 terawatt-hours by 2028, up from 176 TWh in 2023. AI alone could account for 35 to 50% of all data centre power use by 2030, driving electricity demand that the International Energy Agency projects will exceed 250 TWh in the United States by 2026.

This growth trajectory reveals a hard truth: most American electrical grids cannot absorb this load. Grid interconnection queues now stretch seven years in some regions. Utilities typically project demand in years, not months. Yet AI data centre projects announce gigawatt-scale builds on quarterly timelines. The result is gridlock, not shortage, but misalignment between infrastructure build cycles and AI deployment speed.

The OpenAI–SoftBank investment sidesteps this bottleneck by securing dedicated generation. SB Energy, a SoftBank subsidiary, is building “powered infrastructure” for the Milam County site, meaning it will secure or develop a power supply in advance of construction. This strategy is not novel, but the scale and speed are unprecedented. The $1 billion reflects the capital intensity: reliable, AI-grade power requires upfront investment in generation assets, transmission interconnects, and battery storage that utility-scale capex cannot keep pace with.

Tactically, the partnership locks in three critical advantages: stable, long-term power pricing independent of volatile wholesale markets; faster site commissioning by pre-securing grid access; and reduced regulatory risk through private coordination rather than utility-led coordination. SB Energy becomes both developer and infrastructure provider, collapsing the permitting and construction timeline by months.

The broader implication is market-shaping. Hyperscalers are signalling that grid constraints, not capital scarcity, will determine AI infrastructure deployment. This reshapes investment logic across renewable energy, battery storage, and transmission. Wind and solar developers near data centre clusters gain immediate offtake demand. Regional transmission operators face pressure to prioritize data centre interconnections over traditional industrial or residential projects. Local regulators, already overwhelmed by proposal volume, now confront concentrated power demands from well-capitalized tech firms with explicit White House backing.

This deal could accelerate the development of renewable energy projects, as data centres seek to secure clean, reliable power. It may also drive innovation in energy storage and grid management technologies, as the need for flexible, responsive power solutions becomes more acute. Moreover, it could spur policy changes, as governments grapple with the implications of concentrated power demands and the need for more resilient, adaptable energy infrastructure.

In the short term, this investment could lead to a wave of similar projects, as other tech giants seek to secure their own dedicated power supplies. In the long term, it could reshape the energy landscape, driving a shift towards more decentralized, flexible, and resilient power systems. The OpenAI–SoftBank deal is not just about building a data centre; it’s about reimagining the future of energy in the age of AI.