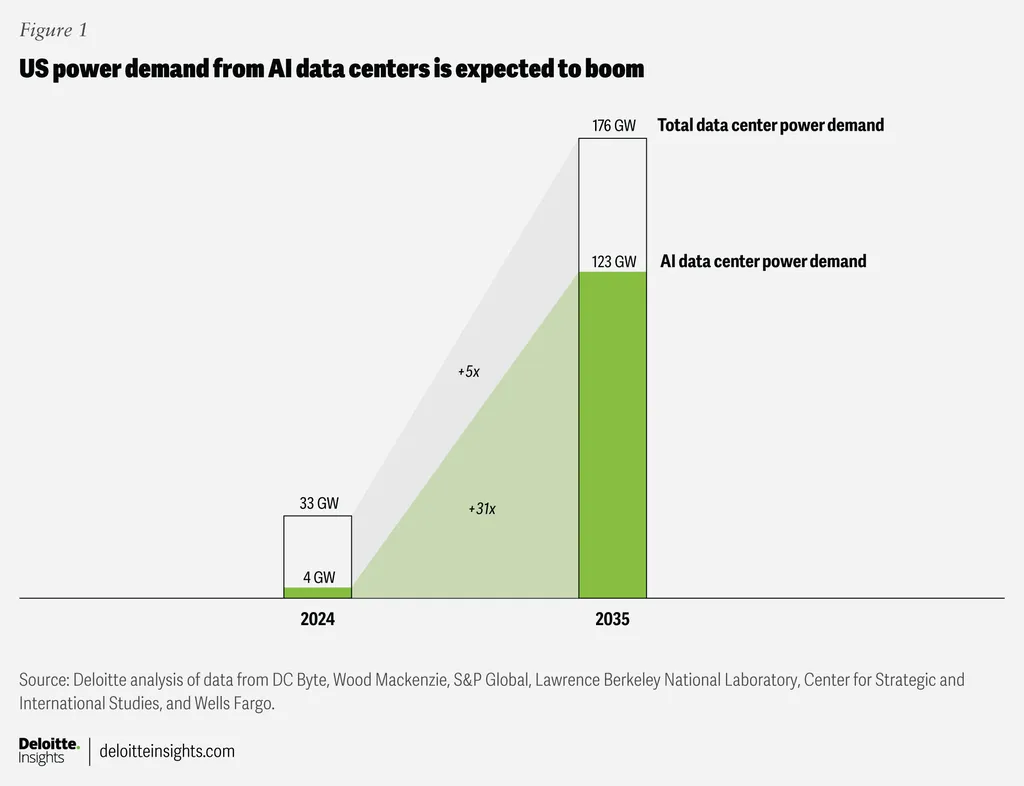

The surging demand for electricity driven by the expansion of AI data centers is poised to reshape the utility sector, offering significant opportunities for growth and investment. As AI technologies advance, the specialized chips and cooling systems required to maintain data centers operating around the clock are consuming vast amounts of power. This trend is setting the stage for utilities to become key beneficiaries, as they expand their power generation and infrastructure to meet the escalating demand.

NextEra Energy, with its extensive operations in Florida, is well-positioned to capitalize on this trend. Florida’s favorable tax exemptions for large data centers and Florida Power & Light’s unique tariff structure provide a strong foundation for growth. NextEra Energy Resources, a subsidiary focused on clean energy infrastructure, is also poised to benefit, particularly through its strategic partnership with Google. The company’s ambitious growth targets, including an 8% annual increase in adjusted earnings per share and continued dividend growth, underscore its confidence in the sector’s potential.

Dominion Energy, serving a significant portion of the East Coast, is another major player in this evolving landscape. Virginia’s status as a global hub for data centers, coupled with Dominion’s substantial investment plans, positions the company to meet the rising demand. The $50 billion capital investment plan, which includes the Coastal Virginia Offshore Wind project, highlights Dominion’s commitment to expanding its power generation capacity. The company’s expectation of 5% to 7% annual earnings growth, along with a robust dividend yield, makes it an attractive prospect for investors.

Entergy, operating in the southern United States, is also gearing up to meet the surging demand. With major projects like Meta Platforms’ $10 billion AI data center in Louisiana, Entergy is investing heavily in new power generation facilities and infrastructure. The company’s $41 billion investment plan and strategic partnerships, such as with NextEra Energy for renewable energy, underscore its commitment to supporting the AI boom. Entergy’s projected 8% annual earnings growth and dividend yield further enhance its appeal to investors.

The implications for the broader market are significant. As utilities expand their capacity and infrastructure, they are likely to attract substantial capital investments, driving economic growth and job creation. The focus on clean energy solutions, such as renewable and nuclear power, aligns with global trends toward sustainability, potentially reducing the environmental impact of the AI boom. Additionally, the robust total return potential of utility stocks, combining earnings growth and dividend income, could make them a compelling option for investors seeking stable, long-term returns.

However, challenges remain. The rapid expansion of AI data centers raises concerns about energy consumption and the need for sustainable power sources. Utilities will need to balance the demand for electricity with environmental responsibilities, ensuring that growth does not come at the cost of sustainability. Regulatory frameworks and policy support will play a crucial role in shaping the sector’s trajectory, influencing investment decisions and operational strategies.

In conclusion, the AI-driven surge in electricity demand presents a transformative opportunity for the utility sector. Companies like NextEra Energy, Dominion Energy, and Entergy are at the forefront of this shift, poised to deliver powerful total returns for investors. As the sector evolves, the interplay between technological advancements, regulatory policies, and environmental considerations will shape the future of utilities, making this an exciting and dynamic space to watch.