The U.S. energy sector is at a crossroads, with the demand for clean electricity surging due to the rise of AI-driven data centers, electric vehicles, industrial reshoring, and increased residential consumption. This shift is pushing major players like NextEra Energy (NEE) and Constellation Energy (CEG) to the forefront, each with distinct strategies to capitalize on the transition.

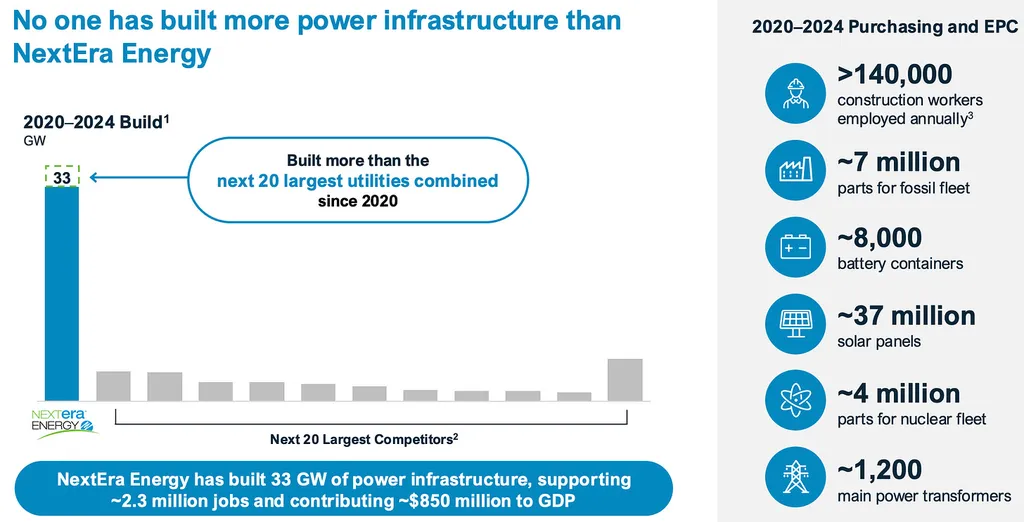

NextEra Energy, a leader in renewable energy, is betting big on wind, solar, battery storage, and grid modernization. Its strong financial performance and innovative approach make it a stable investment with long-term growth potential. The company’s vast portfolio of wind and solar assets positions it well to meet the growing demand for clean energy. Meanwhile, Constellation Energy, one of the largest producers of carbon-free nuclear power in the U.S., offers a compelling investment opportunity with its reliable, high-capacity nuclear plants. These plants provide consistent baseload electricity, minimizing exposure to commodity price fluctuations and supporting predictable cash flows.

The earnings estimates for both companies reveal interesting insights. NextEra Energy’s earnings per share for 2026 have seen a slight increase, with long-term growth pegged at 8.08%. In contrast, Constellation Energy’s earnings per share for 2026 have decreased, but its long-term earnings growth is significantly higher at 15.42%. This disparity suggests that while NextEra Energy may offer more immediate stability, Constellation Energy could provide stronger long-term growth potential.

Dividend yields and return on equity (ROE) further highlight the differences between the two companies. NextEra Energy offers a higher dividend yield of 2.82%, compared to Constellation Energy’s 0.43%. However, Constellation Energy boasts a higher ROE of 21.59%, compared to NextEra Energy’s 12.42%. This indicates that Constellation Energy is more efficient in utilizing shareholders’ funds to generate profits.

Debt to capital ratios and solvency ratios provide additional context. Constellation Energy has a lower debt to capital ratio of 33.46%, compared to NextEra Energy’s 59.04%. This suggests that Constellation Energy is utilizing lower debts to run its operations. Both companies have strong solvency ratios, indicating their ability to meet debt obligations with existing funds.

Looking ahead, both companies have ambitious capital expenditure plans. NextEra Energy plans to invest nearly $74.6 billion in the 2025-2029 period, while Constellation Energy expects to invest nearly $3 billion and $3.5 billion for 2025 and 2026, respectively. These investments are crucial for infrastructure development, system reliability, and long-term growth.

Valuation and price performance also play a role in the investment decision. NextEra Energy is currently trading at a discount compared to Constellation Energy on a Price/Earnings Forward 12-month basis. Over the last six months, NextEra Energy’s shares have gained 17.5%, compared to Constellation Energy’s rally of 11.9%.

The implications for the energy sector are significant. The surge in clean energy demand is driving major investments and strategic shifts. NextEra Energy’s strong dividend yield, better movement in earnings estimates, elaborate capital investment, and cheaper valuation make it an attractive investment. However, Constellation Energy’s higher long-term growth potential and efficient use of shareholders’ funds cannot be ignored.

As the energy sector continues to evolve, the performance of these companies will shape the market’s trajectory. Investors must carefully consider the fundamentals of both companies to determine which one presents the stronger investment opportunity. The choices made today will not only impact the companies themselves but also influence the broader energy landscape, driving innovation and shaping the future of clean energy.