The power sector is at a crossroads, grappling with a fundamental mismatch between the rapid, large-scale electricity demands of hyperscale data centers and the slower, more deliberate pace of infrastructure development. Stephen Empedocles, PhD, founder and CEO of Clark Street Associates (CSA), argues that the industry’s assumptions about data center power needs are flawed, and the consequences could reshape grid planning, supply chains, and even geopolitical competition.

Empedocles, a seasoned executive with over 25 years of experience in advanced technology and a prolific inventor with more than 100 patents, challenges the notion that data centers can function as flexible grid assets. “Downtime carries extremely high financial and operational costs, which limit how much demand they can realistically curtail or shift,” he explained. Even with batteries, delivering tens of megawatts of sustained, dispatchable flexibility is challenging, as these systems are typically designed for resilience and uptime, rather than providing ongoing grid support. Empedocles warns that underestimating the firm generation and transmission capacity required to serve these facilities risks underbuilding the necessary infrastructure.

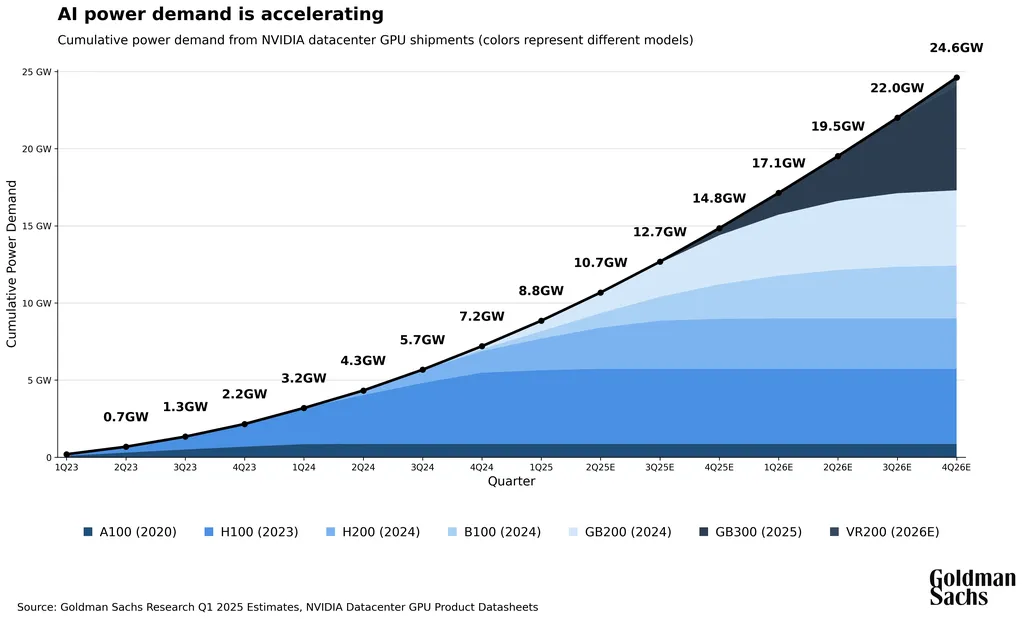

Utilities are caught between the urgent demand from hyperscalers and legacy systems ill-equipped to match that pace. Empedocles cautions that without aggressive upgrades to transmission and distribution (T&D) networks, streamlined permitting for power plants, and better demand management, the U.S. risks falling behind—not just on infrastructure, but on power availability itself. “Leadership in AI is now determined by who can reliably power data centers at scale, rather than just how quickly they can be built,” he said. China’s aggressive moves in both generation and grid capacity are outpacing the U.S., and traditional infrastructure timelines won’t close that gap.

Looking ahead to 2026, Empedocles expects large, centralized grid infrastructure to dominate federal funding. The next stage of grid modernization support will likely focus on large transmission and centralized generation projects rather than distributed energy resource-focused, grid-edge solutions. “Massive AI-driven data centers, along with the dedicated power plants being built to serve them, create a clear federal mandate centered on cost, reliability, and the efficient movement of bulk power,” he explained. While demand response and virtual power plant models can help address peak conditions, they don’t eliminate the need for new baseload generation.

Empedocles also argues that federal attention on critical minerals should expand beyond rare earth elements to include other high-risk materials like antimony, gallium, germanium, rhodium, and tungsten. These materials are critical to power infrastructure, electronics, and industrial systems but remain vulnerable due to concentrated global control. The more fundamental issue, however, is processing capacity. Traditional smelting and refining facilities take years to permit and construct, requiring enormous amounts of electricity at a time when AI and data centers are already straining supply. Without processing technologies that reduce power intensity and capital cost, expanding domestic processing at scale will remain difficult.

Perhaps the biggest mistake the power sector is making, according to Empedocles, is approaching Washington the same way it did a few years ago. The era of fixed programs with defined applications and expected outcomes is over. Federal support is increasingly structured as a bundle of levers rather than a single source. Equity, loans, permitting coordination, and more—these non-cash elements can be what ultimately move a project along. Companies that continue to seek funding through traditional channels are likely to encounter roadblocks or leave value on the table. The organizations that successfully receive support will be those that come to Washington knowing what the right outcome looks like for their business, then develop a strategy that leverages the full range of tools government can deploy.

This news could shape the development of the sector by prompting a reevaluation of data center power assumptions, accelerating infrastructure upgrades, and encouraging a broader focus on critical mineral supply chains. It may also drive a shift in how the power sector engages with federal funding, emphasizing the need for a more strategic, holistic approach.