Alphabet’s acquisition of Intersect Power for $4.75 billion signals a strategic pivot in the tech giant’s approach to data center expansion and energy infrastructure. This move comes as the race to deploy data centers and their accompanying energy systems intensifies, driven by the burgeoning demands of artificial intelligence. The deal underscores a growing trend in the tech sector: the need for vertical integration of energy and data center development to ensure reliable, scalable, and sustainable power supply.

Intersect’s portfolio, valued at $15 billion, includes operational and in-development data center and energy assets. By 2028, Intersect had planned to deliver 10.8 gigawatts of power, a capacity that will now bolster Alphabet’s infrastructure. Sundar Pichai, CEO of Alphabet and Google, emphasized that Intersect will enable Alphabet to expand capacity and operate more agilely, aligning power generation with data center demand. This integration could set a precedent for how tech companies approach energy infrastructure, potentially influencing competitors to follow suit.

The acquisition also highlights the increasing importance of energy innovation in the tech sector. Intersect’s focus on diversifying energy supply and developing emerging technologies aligns with Google’s goals to advance its data center projects sustainably. Sheldon Kimber, Intersect’s CEO, noted that the deal will accelerate innovation at scale, positioning the company to play a pivotal role in shaping the future of energy infrastructure.

However, the acquisition raises questions about the broader implications for the energy market. As data center power demand is projected to reach 106GW in the next decade, concerns about grid stability and energy supply become more pressing. Google’s recent decision to pause AI data center expansions to prevent overloading grids underscores these challenges. The acquisition could spur other tech giants to invest in similar vertical integration strategies, potentially reshaping the energy landscape.

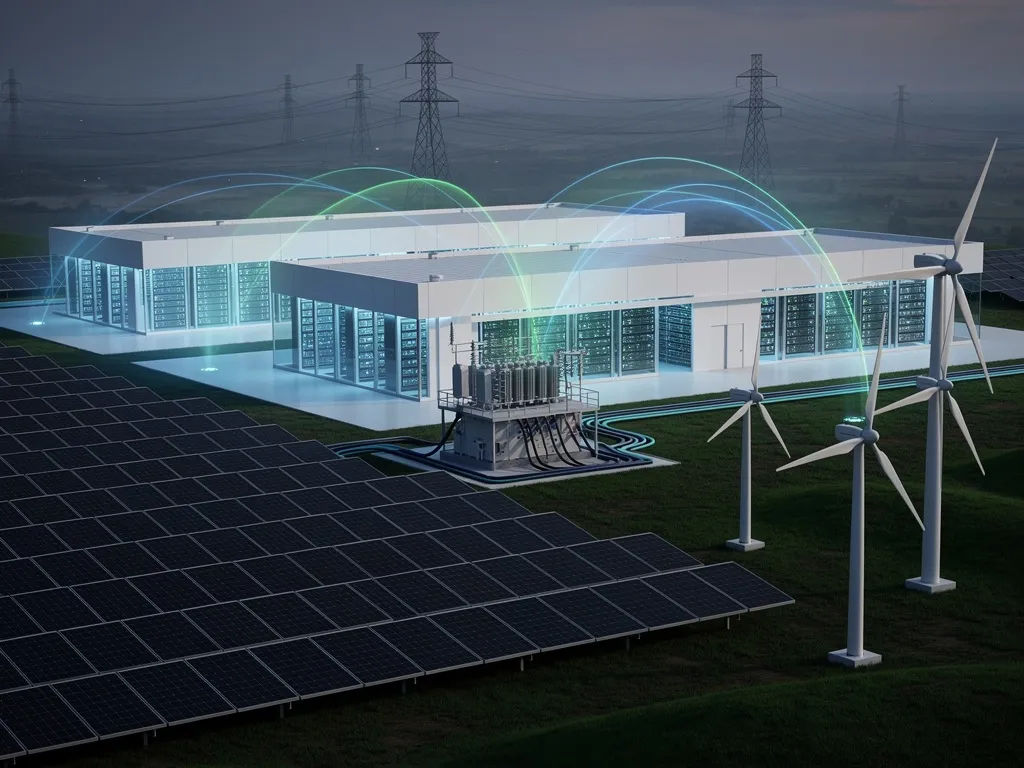

Moreover, the deal reflects a shift towards decentralized energy solutions. Kimber’s assertion that the US model is increasingly “bring your own generation” suggests a move away from reliance on traditional grid infrastructure. This approach could accelerate the deployment of renewable energy sources paired with flexible backup systems and energy storage, potentially unlocking new opportunities for innovation in the energy sector.

Yet, the acquisition also underscores the environmental challenges facing the tech industry. Despite Google’s investments in renewables, its greenhouse gas emissions have surged by 48% since 2019, driven by data center electricity use. The integration of Intersect’s capabilities could help address these challenges, but it remains to be seen whether such efforts will be sufficient to meet the sector’s growing energy demands sustainably.

In the broader context, Alphabet’s acquisition of Intersect could catalyze a wave of similar investments in the tech and energy sectors. As companies grapple with the dual demands of AI-driven growth and sustainability, vertical integration of energy and data center infrastructure may become a strategic imperative. This trend could reshape market dynamics, fostering innovation and competition in the energy sector while posing new challenges for traditional utility providers.

Ultimately, the deal serves as a bellwether for the future of tech and energy infrastructure. As the sector evolves, the interplay between data center expansion, energy innovation, and sustainability will be critical. Alphabet’s acquisition of Intersect is not just a business move; it’s a statement about the future of technology and energy, one that will likely inspire both imitation and adaptation across the industry.