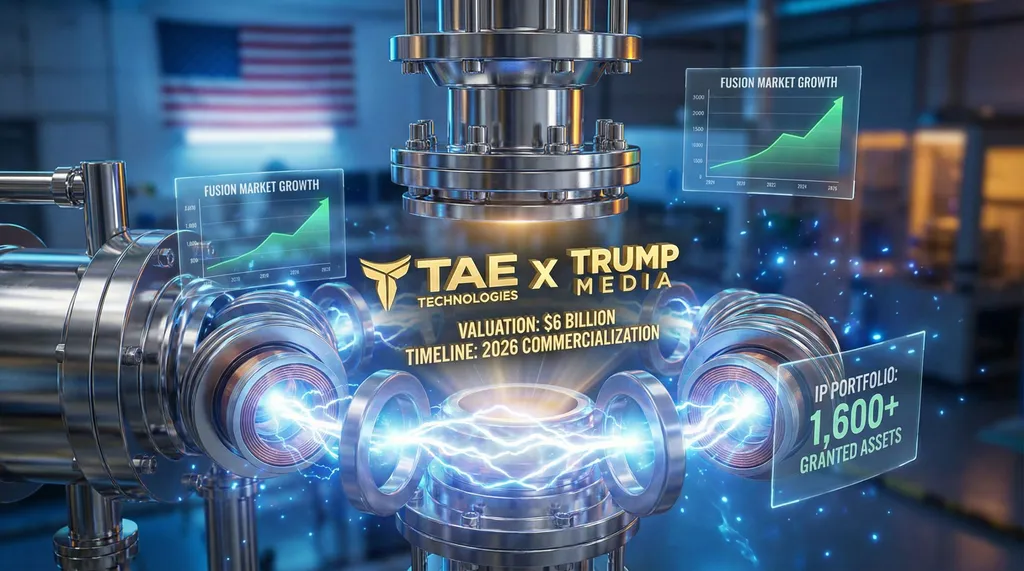

The fusion industry has just witnessed a seismic shift, not in the realm of scientific breakthroughs, but in the arena of capital mobilization. On December 17, Trump Media & Technology Group (TMTG) announced a $6-billion all-stock merger with fusion power company TAE Technologies (TAE). This deal, aiming to fast-track TAE’s growth, marks a pivotal moment in the energy sector, with implications that could reverberate far beyond the boardrooms of the merging entities.

The merger, structured as an equal shareholder stake, provides TAE with up to $300 million in funding. This capital injection is earmarked to initiate the construction of utility-scale fusion plants as early as 2026. The deal is not just about infusing funds; it’s about creating a large-cap, pure-play fusion stock on a major U.S. exchange. This move allows direct public investment in fusion, a departure from the traditional reliance on venture capital and sporadic government investment.

Critics argue that for TMTG, this merger is a strategic pivot, a means to transform from a struggling social media player into a vehicle for fusion’s promise. TMTG’s shares have plummeted over 70% in the past year, making this deal a potential lifeline. For TAE, it’s an opportunity to accelerate its growth and establish itself as a major player in the U.S. fusion energy landscape.

The impact of this merger could be profound. It could create desperately needed generation capacity to power AI and meet growing energy demand. It could transform global energy markets, forcing TAE’s competitors to follow suit and pulling fusion into every serious conversation about the future of energy.

The fusion industry’s progress has been remarkable this year, with record private funding and political support. However, the sector has long faced a funding challenge, particularly in the “valley of death” between prototype and commercial plant. The TMTG-TAE deal addresses this by providing deep, sticky capital that venture capital cannot match. It enables investors to get in early on the next transformative technology for the energy grid.

The era of “stealth mode” fusion is over. The TMTG-TAE deal proves that the race for fusion isn’t just technical—it’s about capital mobilization. Fusion is now a front-of-house player in capital markets, and its progress will be tracked in SEC filings, project finance structures, and offtake agreements. This deal exerts intense pressure on peer fusion companies like Helion, Commonwealth Fusion Systems, and Type One Energy. If TMTG-TAE trades at a premium, their own investors will demand public listings to avoid missing this wave of public funding.

However, risks and discomfort around the TMTG-TAE deal loom large. Critics see potential conflicts of interest, permitting favoritism, and backlash if milestones slip or retail investors feel misled. The market risks are also stark, with TMTG’s history of trading less on fundamentals than on political news cycles and retail enthusiasm. Achieving the ambitious 2026 timeframe for beginning construction of a utility-scale fusion plant hinges on TAE overcoming various technical and regulatory hurdles.

The power sector must prepare for the coming shift in fusion funding and market dynamics. Fusion developers will likely prioritize commercial projects for high-demand sites like AI data centers, industrial hubs, and defense facilities. This will require regulators to facilitate and utilities to model new siting, grid connections, and contract approaches.

The TMTG-TAE merger completely changes and amplifies the dialogue about fusion. No longer just a complement to renewables, fusion is reframed as the indispensable backbone to sustaining AI and data centers’ massive power needs. For TAE, attaching to a public company like TMTG changes investor psychology. People who have long wanted to invest directly in fusion, from AI hyperscalers to clean energy enthusiasts, will flock to the early public movers. Fusion has struggled to get sufficient attention because the science and commercialization seemed decades away. Now, tied to America’s most talked-about figure, fusion has officially gone mainstream, joining debates on grid reliability, AI sovereignty, national security, and energy independence.

This merger is a bold experiment, a pivot for survival, and a potential game-changer for the fusion industry. It’s a wake-up call for the power sector and a catalyst for the next generation of baseload energy. The implications are vast, and the stakes are high. The fusion industry, and indeed the entire energy sector, is watching closely.