The Federal Reserve’s decision to lower interest rates has injected a much-needed boost into the clean energy sector, a move that could reshape the industry’s trajectory in the coming years. The timing of this shift is critical, as the sector has weathered significant turbulence in recent years, from policy whiplash to soaring interest rates.

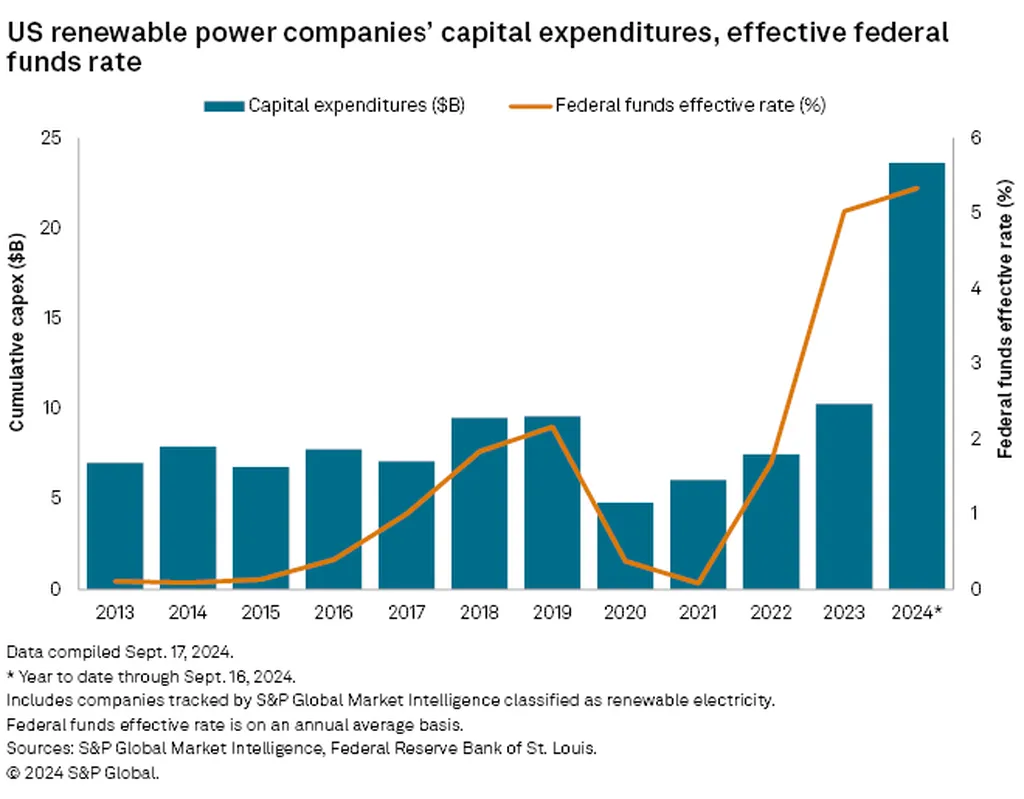

The clean energy sector’s unique financial structure—where the bulk of costs are incurred upfront—makes it particularly sensitive to interest rate fluctuations. High interest rates can stifle investment, delaying or even derailing projects. The Fed’s rate cuts, therefore, come as a relief, potentially unlocking a wave of new projects that had been stalled by high borrowing costs.

The recent rate cuts have already begun to reverberate through the market. In September, renewable energy funds saw their highest monthly investment since April 2022, with $800 million flowing into the sector. This surge in investment is a clear sign that confidence in clean energy’s future is rebounding.

Moreover, the rate cuts coincide with a surge in demand for electricity, driven by the expansion of data centers to power AI and the proliferation of EV chargers. This growing demand underscores the urgent need for new energy capacity, a gap that renewables are well-positioned to fill. NextEra Energy predicts an additional 450 GW of generation by 2030, a target that lower interest rates will help achieve.

The implications for markets are profound. Lower interest rates make clean energy a more attractive investment, offering higher returns and greater predictability than traditional stocks. This shift is evident in the performance of the iShares Global Clean Energy ETF, which surged 30% from January to September. Similarly, Bloom Energy’s stock shot up 300% after announcing a deal with Oracle, a testament to the renewed optimism in the sector.

The rate cuts also signal a broader shift in market sentiment. BlackRock and Robeco report that investors are now more bullish on clean energy than they were a year ago, a sentiment echoed by JPMorgan Chase’s $10 billion commitment to clean energy projects. This renewed confidence could catalyze a wave of innovation and investment, accelerating the transition to a cleaner energy future.

However, the path forward is not without challenges. The incoming administration’s stance on clean energy remains uncertain, and policy shifts could create headwinds. Yet, the market’s response to the rate cuts suggests that the momentum for clean energy is building, driven by both economic and environmental imperatives.

As the sector navigates these challenges, one thing is clear: the Fed’s rate cuts have provided a significant tailwind, one that could reshape the clean energy landscape in the years to come. The question now is how the sector will capitalize on this opportunity, and what innovations and investments will emerge to drive the transition forward.