The solar industry is at a crossroads. Distributed generation (DG) solar projects are in high demand, yet many are stalling before they even begin construction. The bottleneck? Utility interconnection. For community or net metered solar systems, particularly those in the 1 MW to 5 MW range, the utility’s review of grid capacity has become the defining step in the development process.

In theory, the process is straightforward. Engineers submit detailed plans to the utility, which reviews the local circuit and substation to confirm it can safely accommodate the new power. If the system can handle the generation, the project proceeds. In reality, it’s far from simple. I’ve seen clients secure land, financing, and engineering plans, only to sit in limbo for months or even years waiting for utility approval. Depending on the state and utility, an interconnection review can take anywhere from nine months to four years. These delays reshape the economics of entire portfolios of DG projects. Owners lose interest, incentive windows close, and the finance community begins to doubt whether a project will ever reach construction and energization. Some developers eventually walk away.

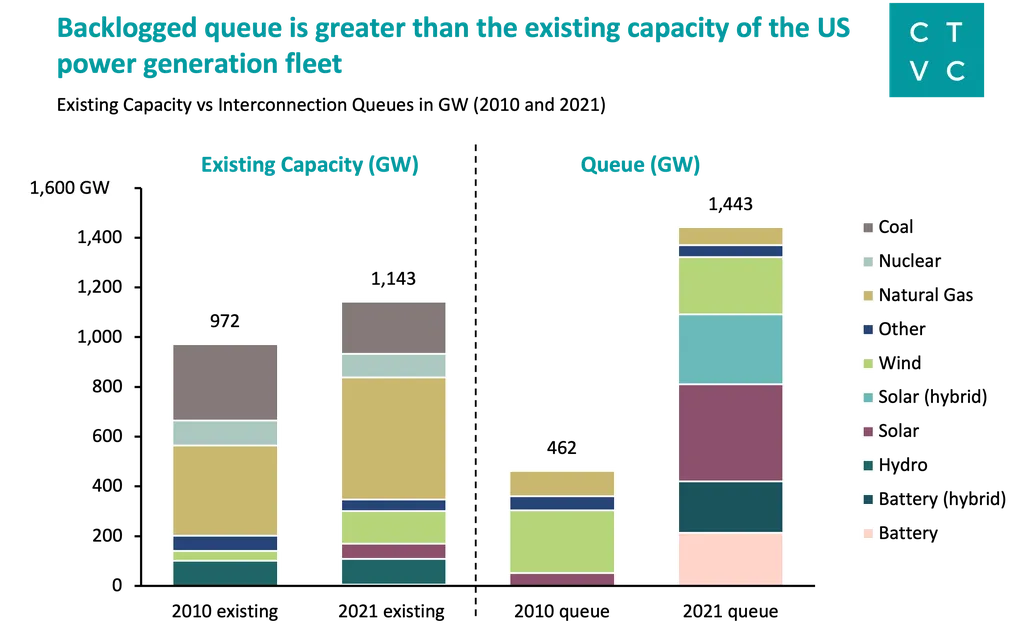

Several forces are behind these slow-moving interconnection reviews. Recent state incentives have triggered a land rush, especially in states with good community solar programs. Utilities must study every application and the existing circuits they will be added to, a task many are not staffed or designed to handle. Additionally, utilities often only conduct interconnection reviews during specific times of the year, further delaying the process.

A second challenge is about incentives. Utilities make money by serving load, not by adding new sources of power. Major electricity consumers such as data centers or electric vehicle charging campuses are financially attractive and often receive fast-tracked studies. A 5-MW solar project, on the other hand, does not buy power and competes with the utility’s own sales, creating little incentive for the utility to move quickly.

When upgrades are required to accommodate new generation, utilities often assign the full expense to the first project in line, even if many others will eventually use the same circuit. Upgrade estimates of $5 million to $10 million can be placed on a single project, pushing otherwise viable projects out of reach. Some states now allow cost sharing, but many do not.

It’s important to recognize that utilities are not acting out of hostility toward solar. Their first responsibility is to protect the stability and safety of their systems. Many utilities view flexible interconnection as a significant operational change and adopt new practices slowly. From their perspective, caution is tied to risk management and reliability, not simply an unwillingness to see more DG on the grid.

Fortunately, new tools are emerging that can ease this bottleneck. Smart inverters and flexible interconnection strategies make it possible to connect projects more quickly and at lower cost, even on circuits that may appear constrained. The irony behind these huge utility upgrade costs is that this added generation is not seen on the system the vast majority of the time. Flexible interconnection offers a practical way around this. The idea relies on modern smart inverters and distributed energy resource management systems, which allow utilities to dial back a solar project’s output when a circuit begins to approach its limits.

Instead of reinforcing miles of utility infrastructure and updating outdated protection schemes, the utility can manage those rare peak moments by reducing output temporarily. The technology is already a standard feature in most inverters. Many manufacturers now include “smart inverter” capabilities to meet IEEE 1547-2018 requirements, so the added cost is minimal. The key is control of the system, which allows the utility to send an automated signal that trims generation only when needed.

For developers, the tradeoff is simple. A brief, occasional reduction in output is far easier to absorb than years of delay and multimillion-dollar upgrade bills. The approach already works in practice. One of our clients in Illinois agreed to a flexible interconnection arrangement more than two years ago, and the system has not been curtailed a single time since it went online. This approach is relatively easy for developers to evaluate. Curtailment can be plugged into the same energy modeling software they already use, so they can see how much power they might actually lose over a year. In most cases, even the cautious estimates show that the impact on annual production would be small compared to the upgrade costs utilities often propose.

Some utilities remain reluctant to adopt flexible interconnection. Their hesitation often stems from internal issues, such as limited staff, outdated procedures, or unfamiliarity with new grid management tools. Yet the technology itself is already in place. Some utilities use similar systems to manage residential air-conditioning load during peak events, which means the shift to smart-inverter curtailment is more of an operational adjustment than a technical one. That choice now matters more than ever. The Inflation Reduction Act (IRA) tightened the timeline for the federal tax incentives associated with solar