The energy sector’s historical relationship with foreign direct investment (FDI) is undergoing a significant shift, driven by the global transition to renewable energy and heightened geopolitical tensions. This evolution is reshaping investment patterns, regulatory frameworks, and market dynamics, with profound implications for the sector’s future.

The energy sector was an early adopter of FDI, initially focused on hydrocarbon resources. However, the landscape has since expanded to encompass renewable energy infrastructure, digital technologies, and strategic assets. This shift is not merely a change in investment targets but a fundamental reorientation of the sector’s priorities and vulnerabilities.

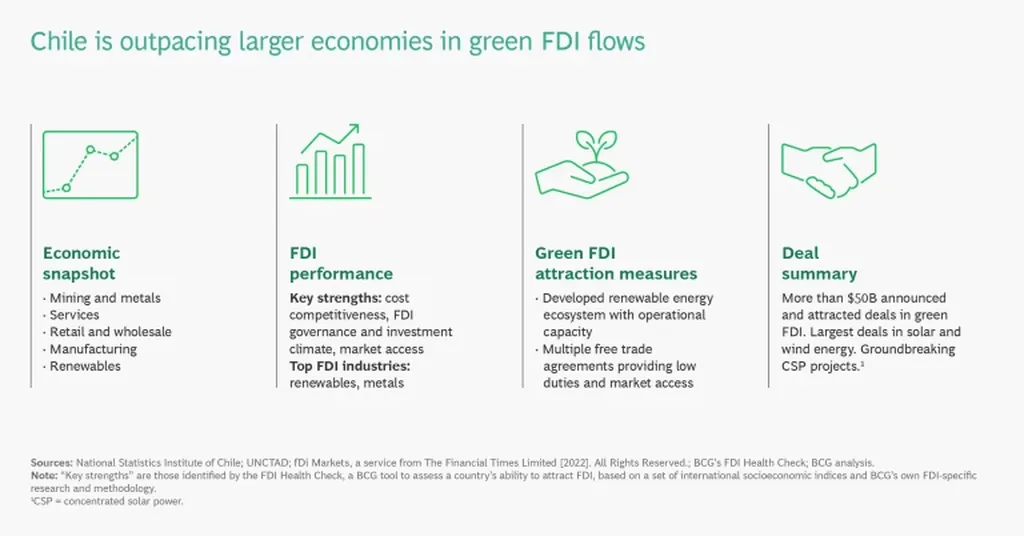

The transformation of the energy sector from hydrocarbon to renewable sources has created a massive investment opportunity. The infrastructure required to generate, transport, and store ‘green’ electricity, hydrogen, or biofuels, along with the digitalisation of existing infrastructure, demands substantial capital. This investment surge is attracting a diverse range of investors, including state-owned, state-sponsored, or state-influenced entities, which often pursue strategic goals beyond mere financial returns.

Concurrently, there has been a global trend of governments tightening FDI control regimes, particularly in Western countries. The focus has shifted from industrial policy to national security, with a keen eye on the potential impact of investments on security of supply, infrastructure operation, and national security. This heightened scrutiny is reflected in the diverse and often complex FDI control mechanisms that have emerged, including general FDI regimes, sector-specific legislation, ‘golden share’ laws, and re-nationalisation efforts.

The United States, for instance, has broadened the scope of its Committee on Foreign Investment in the United States (CFIUS) to cover a wide range of energy infrastructure and technologies. This includes renewable energy generation and storage, which are now deemed critical technologies. Similarly, the European Union and its member states have aligned their FDI screening processes through the EU’s FDI Regulation, which explicitly covers critical infrastructure, critical technologies, and the supply of critical inputs, including energy.

The implications of these developments for the energy sector are manifold. Firstly, the increased regulatory scrutiny and complexity may deter some investors, potentially slowing down the pace of the energy transition. Secondly, the focus on national security may lead to a more fragmented global energy market, with countries prioritising domestic interests over international cooperation. Thirdly, the heightened geopolitical tensions may exacerbate existing tensions between countries, further complicating investment decisions and market dynamics.

However, these challenges also present opportunities. The increased focus on national security and strategic interests may accelerate the development of domestic energy markets and technologies. The tightening of FDI control regimes may also lead to a more level playing field, with all investors subject to the same rules and scrutiny. Moreover, the global trend towards renewable energy and digitalisation may foster innovation and collaboration, ultimately benefiting the sector as a whole.

In conclusion, the evolving landscape of FDI in the energy sector is a double-edged sword, presenting both challenges and opportunities. As the sector continues to transform, it will be crucial for policymakers, investors, and market participants to navigate these complexities and work towards a secure, sustainable, and prosperous energy future. The developments in FDI control regimes serve as a reminder that the energy sector is not just about economics and technology, but also about politics, power, and the strategic interests of nations.